Bank of America published a playbook Tuesday on how to spot recessionary bear markets and which assets perform best during downturns.

The BofA research team named the following three major signs predicting a market crisis by analyzing the previous 150 recession events since 1800 and 16 S&P 500 bear markets during economic downturns:

- 1) Steepening of the Treasury yield curve.

- 2) Stringent lending conditions by banks.

- 3) Fed forced to cut interest rates.

Only the third requirement has yet to occur. Contrary to popular belief, recessionary bear markets generally cause a 25% further decline in stocks following the Fed's first rate cut, according to BofA.

Bank of America Equity & Quant Strategist Savita Subramanian targets 4,000 on the S&P 500, which is tracked by the SPDR S&P 500 Trust ETF SPY. The stock market might go as low as 3,000 due to dangers such as a recession, more earnings cuts and weakening cyclical indicators, the analyst said.

Yield Curve Inversions Anticipates Recession

The three-month Treasury bill yield is 135 basis points above the yield on a 10-year Treasury note, according to BofA — the most inverted spread since 1981.

Eight of 10 such yield curve inversions came before recessionary bear markets going back to 1921, the analysts said.

"Markets typically trough 17 months after the curve starts to steepen, as the 2yr/10yr has done."

Stocks are defying credit-crunch fears and have not yet been priced for a recession, according to BofA. Typically, the S&P 500 price/earnings ratio declines by 6.3, but earnings have yet to fall to historical norms, implying a further 20% downside risk in stocks.

BofA is pessimistic on the technology sector on the basis of its valuations being among the most expensive. The research team highlighted that five companies have averaged 35% returns this year, accounting for 21% of the S&P 500 and 44% of the Nasdaq 100, while the remainder of the market has averaged low single digits.

Investors have another chance of profiting from inflated bonds and stocks, according to BofA.

Technicals Signal Changing Mood: Paul Ciana, head of technical strategy at BofA, said the breadth of market technicals is heading toward more risk aversion in the second quarter of the year, which should favor bonds over stocks.

“If the S&P 500 ever goes below the 200-week average, which today has risen to approximately 3,750, then the risk of a secular decline increases like those seen in the 1970s inflationary cycles,” the analyst said.

The chart below demonstrates that every time the S&P 500 fell below its 200-day moving average, the bear market intensified.

Investing During A Recession: The BofA US Regime Indicator has now shifted toward "Downturn" mode. Defensive stocks such as staples, small caps, value, corporate bonds and gold tend to perform better during downturns and recovery periods, the analyst firm said.

BofA likes the iShares U.S. Consumer Staples ETF IYK, the Pacer US Small Cap Cash Cows 100 ETF CALF, the Vanguard Value ETF VTV, the iShares Fallen Angels USD Bond ETF FALN and SPDR Gold Trust GLD.

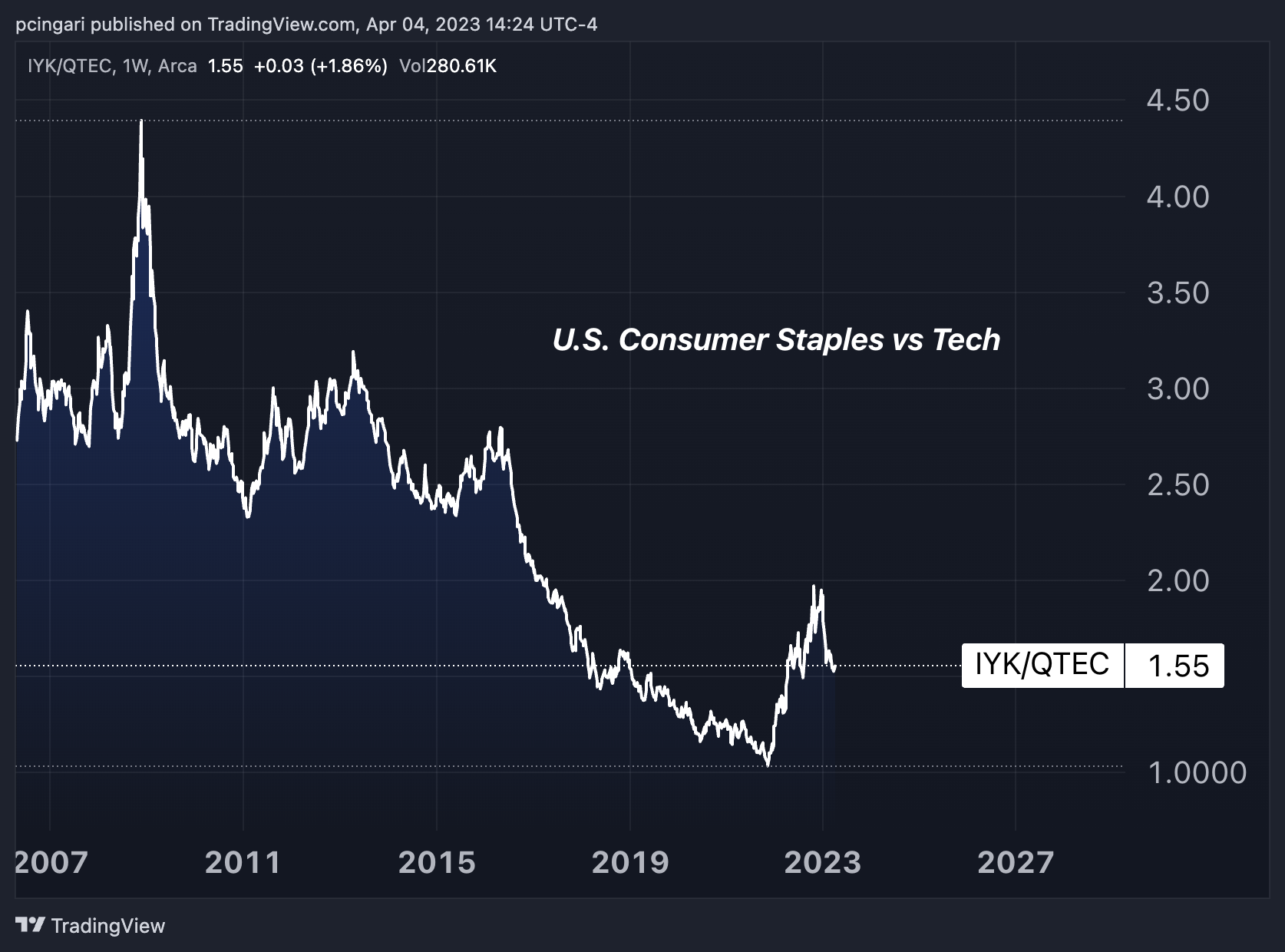

BofA's favorite trade for the next phase of this bear market is long staples (IYK)/short First Trust NASDAQ-100-Technology Sector Index Fund QTEC.

Staples remain undercapitalized and may benefit from "trade-down" effects this year as customers look for lower-cost options, BofA said.

Technology is unreasonably expensive, too concentrated, and has outperformed only under two downturn regimes, the analysts said: the dot-com bubble and Covid.

Read next: What's Going On With Bank Of America (BAC) And Wells Fargo (WFC) Shares

Photo via Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.