The Federal Reserve‘s policy-setting arm, the Federal Open Market Committee, kicks off a two-day meeting on Tuesday, with the futures market pricing in another pause decision. Tesla investor and CEO of Gerber Kawasaki Wealth and Investment Management, Ross Gerber, offered his take on what the central bank should be doing over the next year.

What Happened: In a social media post on Monday, Gerber said interest rates “are way too high.” His view aligns with that held by many analysts, including Ark Investment Management founder Cathie Wood.

Gerber mentioned that the Fed, with its hawkish stance, is “snuffing out small businesses and will eventually cause many more bankruptcies and defaults.”

“The Fed is killing innovation in America,” he added.

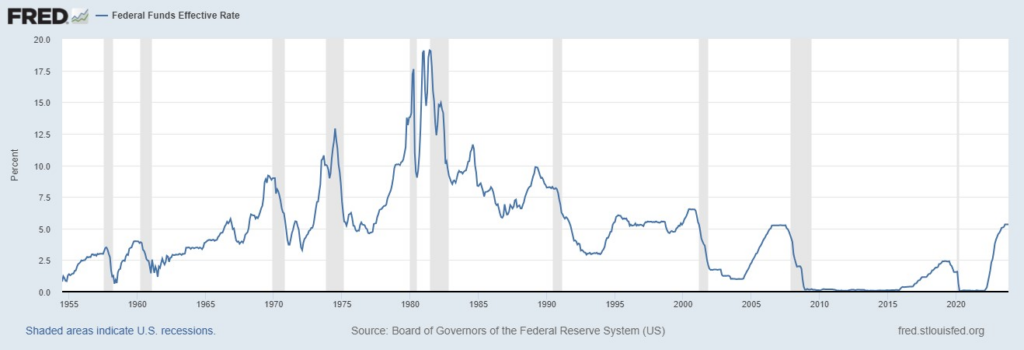

The Jerome Powell-led central bank began raising rates in March 2022 from near-zero levels to a 22-year high of 5.25%-5.50%. After raising rates in each of its meetings, the Fed has held fire in each of the past two meetings.

The high-interest rate environment has hurt companies and consumers alike, with the former impacted by a cautious consumer and falling business spending. Data provided by Layoffs.fyi show that layoffs in the tech industry since the start of 2022 have totaled 422,522. Workforce reduction has been the preferred strategy of companies this time around to rein in expenses and preserve profitability amid economic headwinds.

See Also: Best Inflation Stocks

What’s Next: Gerber has a piece of advice for Powell & Co. as they converge for the final meeting of the year.

“The Fed should cut by at least 100 basis points next year, preferably in the first half,” the fund manager said. “This will protect the economy while maintaining higher rates.”

Gerber noted that the market has already priced in rate cuts, with the yield on the benchmark 10-year note at 4.26%, a full percentage point below the fed funds rate. The effective fed funds rate is the interest rate at which depository institutions trade federal funds with each other overnight.

Chart Courtesy of St. Louis Fed

The Fed rate cut expectations have been the theme that reignited the market rally witnessed after its August-October slump. The broader market is up solidly for the year.

The SPDR S&P 500 ETF Trust SPY, an exchange-traded fund that tracks the S&P 500 Index, settled Monday’s session up 0.39% at $461.99, according to data from Benzinga Pro. The ETF is trading at its highest level since late-March 2022.

The CME FedWatch Tool shows that the futures market has priced in a 98.4% probability of a pause decision on Wednesday.

With a pause all but certain, the focus will be on the post-meeting policy statement and the Fed’s dot-plot curve, released as part of the updated summary of economic projections, as well as Powell’s press conference. Investors are likely to sift through these to spot any potential change in language and tone that could provide cues to the near-term monetary policy trajectory.

Not everyone agrees with Gerber. LPL Financial Chief Equity Strategist Jeffrey Buchbinder said in a recent note that a Fed rate cut may not generate much upside in the market.

“Once the cut comes, typically the Fed has gone too far and a recession is near (or already started),” the analyst said. “Further, markets tend to get jittery ahead of the cut.”

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.