Shares in Stellantis NV STLA, the multinational carmaker, have enjoyed a stellar ride during the past year and investors are hoping this will be justified by its full-year earnings to be revealed on Thursday.

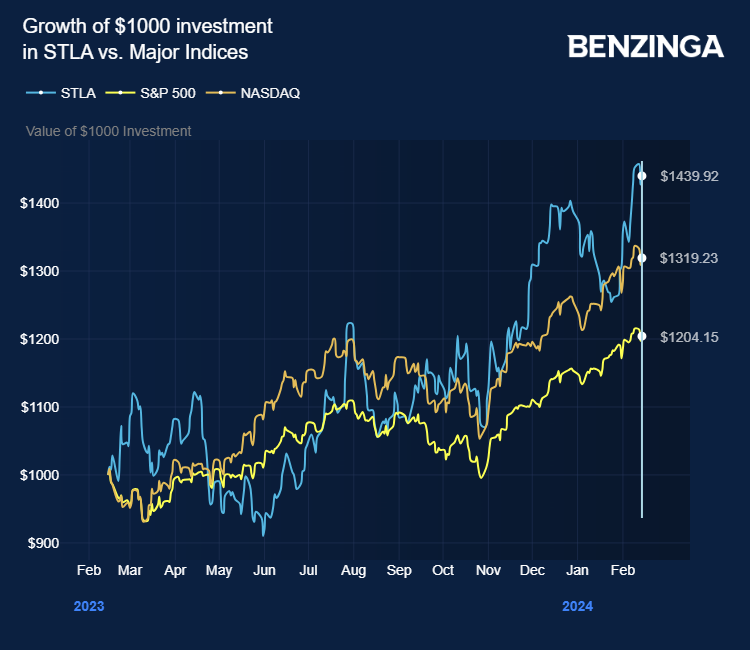

Shares have gained 44% over the past year. Compare this with rivals Ford Motor Co F, which was down 2.7% over the same period, and General Motors Co GM with a loss of 11%.

What has the owner of Chrysler, Dodge and European marques Citroen, Fiat and Alfa Romeo done right that Ford and GM have not?

Complex Structure

Stellantis retained its focus on consumer-pleasing mass-market models and — particularly in Europe — its range of electric vehicles has been well received. The company aims for 100% of European sales to be battery electric vehicles by the end of the decade and 50% in the U.S.

While the company has a complex structure, made up of multinational brands, primary stock listings in Paris, Milan and New York, and a 6% stake held by the French government, CEO Carlos Tavares has driven the company to achieve strong margins and quality earnings.

In the first half of 2023, revenues were up 14% to $50.6 billion off a 7% increase in shipments.

Full-Year Results Expectations

It’s not been an easy year for U.S. carmakers, hit by just over a month-long strike by auto workers union members in the fourth quarter. However, both Ford and General Motors reported forecast-beating fourth-quarter results.

So, what’s expected from Stellantis on Thursday?

Consensus estimates put Stellantis’ full-year earnings per share at $5.69, which would beat the previous year by 1.6%.

Revenues, meanwhile, are expected to come in at $200 billion for the full year, which would be an increase of 5.7% on full year 2022.

Net cash is expected to total around $32 billion and research and development costs are seen at 7% of sales, according to a recent note from Jeffries.

With such a large cash hoard, investors may be hoping for some good news on shareholder returns at Thursday’s presentation.

“Stellantis management should soon shift to returning capital to shareholders at a more aggressive pace. and may soon announce a significant share buyback program or a special dividend,” said Scott Olson, analyst at Seeking Alpha.

Now Read: Ford Q4 Earnings Highlights: Revenue Beat, EPS Beat, Supplemental Dividend, EV Update And More

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.