The Federal Reserve has adopted a more dovish stance than anticipated, according to veteran Wall Street investor Ed Yardeni.

What Happened: Yardeni stressed that, at the March Fed meeting, “[Jerome] Powell & Co. were more dovish today than we (and stock investors) expected,” maintaining their projection from December for three 25 basis point reductions in the federal funds rate (FFR) within the year.

This decision comes despite adjustments to the median forecast for real GDP growth—to 2.1% from 1.4%—and an increase in the core PCE inflation rate estimate—from 2.4% to 2.6%.

The FFR is projected to decline to 3.1% by 2026, slightly above the long-term rate of 2.6%.

This turn of events fueled market sentiment and propelled the S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, to new heights, further bolstering the current market rally.

During a press conference, Fed chair Powell confirmed the Federal Open Market Committee’s (FOMC) dovish position, stating, “The Committee does not expect it will be appropriate to reduce the [FFR] target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Despite prior hints at tightening policy, Powell remained steadfast.

“We are prepared to maintain the current target range for the federal funds rate for longer if appropriate,” he said.

Yardeni interpreted these comments as an indication of the Fed’s readiness to lower the FFR should inflation continue its downward trajectory, to avoid overly restrictive monetary conditions that could precipitate a recession.

See Also: ‘Rich Dad Poor Dad’ Author Says This Is Not The Time To Buy Stocks And Bonds

Why It Matters: Contrary to some expectations, Yardeni projected, “We are still projecting either no rate cut this year or two at most after the presidential election on Nov. 5.”

He remains optimistic about the market’s direction, targeting an S&P 500 level of 5,400 by year-end—a goal that seems increasingly attainable with the index currently just 3.5% shy of this target.

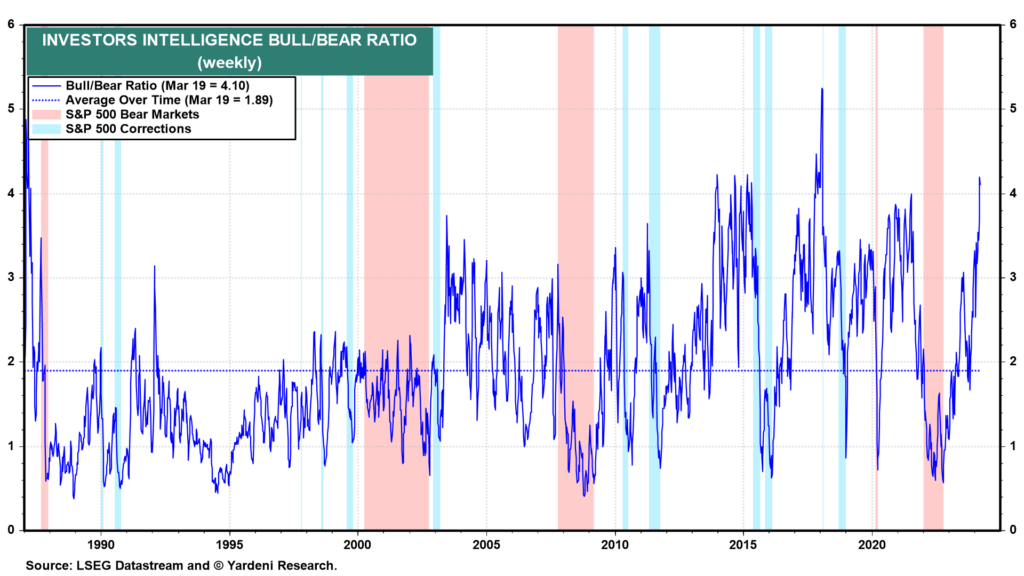

However, the veteran market analyst also highlighted an overwhelmingly positive market sentiment as source of risk going forward. “Almost everybody is bullish,” as evidenced by the Investor Intelligence Bull/Bear Ratio, which stood at 4.1, marking the second consecutive week it has exceeded the 4.0 threshold, which worked as a contrarian signal in the past.

Chart: Yardeni Research

Read Also: Fed Euphoria Keeps US Stocks On Track For More Gains: Analyst Says New Breakout Coming Soon

Image: Flickr

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.