In a surprising turn of events, UBS Group AG has made a rare upgrade call, lifting its recommendation on a key Chinese stock index to Overweight.

As of 2 p.m. ET, Chinese equity tracking ETFs such as the iShares China Large-Cap ETF FXI was trading up 1.52%, KraneShares CSI China Internet ETF KWEB was up 2.86%, and iShares MSCI China ETF MCHI was up 1.26%.

Stocks of Chinese companies also shared in the optimism with Alibaba Group Holding BABA BABAF was up 2.65%, PDD Holdings PDD up 2.87%, Tencent Holdings ADR TCEHY up 3.51%, Li Auto Inc LI up 0.24%, XPeng XPEV up 2.29%, NIO – ADR NIO up 2.50%, and JD.com JD up 2.06%.

UBS Analyst Upgrades China To Overweight

This move comes amidst a backdrop of lingering concerns over China’s property sector and broader macroeconomic worries. However, Sunil Tirumalai, UBS' institutional research Global Emerging Markets equity strategist, pointed to resilient earnings as a beacon of hope in an otherwise turbulent market.

Among the tailwinds highlighted by UBS that support the bullish outlook for Chinese stocks were:

- Interventions from state-related funds.

- Positive surprises in dividends and buybacks from local firms.

UBS has issued a downgrade for Taiwan and South Korea markets to Neutral, citing high premiums in the tech sector, reported BNN Bloomberg. This reflects a broader shift among investors away from frothy valuations in favor of more stable growth opportunities.

Underperformance Attributable To “Valuation Collapse”

According to Tirumalai, the underperformance of China stocks can be attributed solely to a “valuation collapse,” reported CNBC. He emphasized that the largest stocks in the China index have maintained strong earnings and fundamentals, providing a solid foundation for future growth.

To this end, KraneShares’ CIO Brendan Ahern, noted his team’s perspective on China and emerging markets fundamentals differs from conventional views.

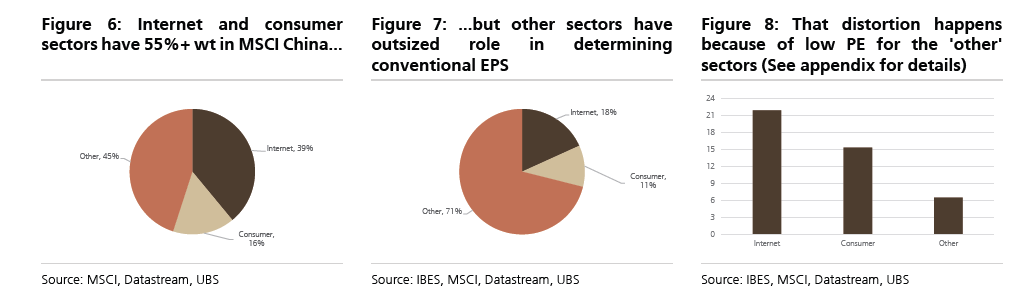

The company believes sector dysfunction in emerging markets and China indices is driving underperformance, particularly due to the large weight of value sectors. Conventional index construction methods, while useful for financial analysis, pose challenges for forecasting.

Stocks with higher P/E ratios have a disproportionately lower weight in earnings per share (EPS), leading to forecasting difficulties. As a result, movements in higher P/E stocks dominate index performance, while EPS is influenced more by lower P/E stocks.

China’s Stock Market: A Potentially Rare Opportunity

In a recent exclusive interview with Benzinga, Henry Greene, investment strategist at KraneShares pointed out, “China’s stock market has bottomed, indicating a potentially rare opportunity.”

We covered his insights here: EXCLUSIVE: ‘China’s Stock Market Has Bottomed, Indicating A Potentially Rare Opportunity,’ Says Investment Strategist

Later, in another exclusive, with Benzinga, Ahern shared “the long-term trend of China investing heavily in developing its domestic chip capabilities and reducing reliance on foreign suppliers.”

The upgrade appeared to fall in line with KraneShares philosophy and outlook toward Chinese equity.

Despite concerns over geopolitical tensions and regulatory uncertainties, Chinese equities have shown signs of resilience, with both the MSCI China Index and the Hang Seng Index posting double-digit gains in recent months.

While risks remain, including heightened geopolitical noise, UBS’s upgrade underscored a growing sense of confidence in China’s economic recovery.

As investors navigate these uncertain times, UBS’s bold call serves as a reminder of the potential opportunities ahead in the Chinese market.

Read Next: EXCLUSIVE: KraneShares CIO Talks Intel And AMD, As China Seeks Semiconductor Self-Sufficiency

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.