GLP-1 market leaders Eli Lilly and Company LLY and Novo Nordisk A/S NVO faced a significant selloff on Thursday, as new weight-loss drugs from rival pharmaceutical companies began threatening the dominance of their flagship products, Zepbound and Wegovy.

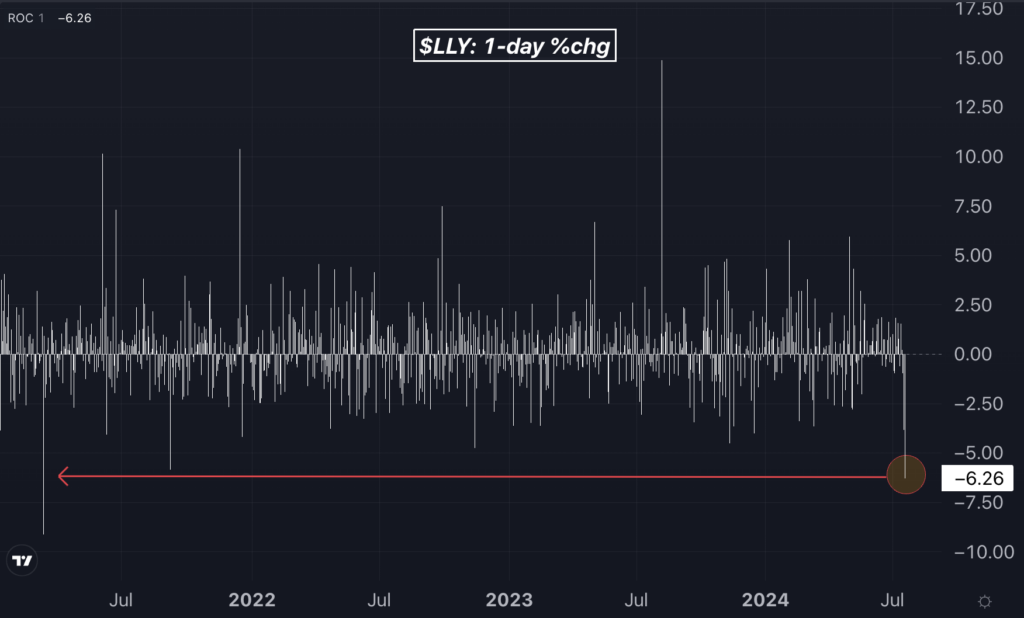

Shares of Eli Lilly plummeted by 6.3%, marking their worst daily performance since March 2021. In the last two sessions, they have dropped by over 10%, registering the worst two-day downside since March 2020. Similarly, shares of Dutch pharmaceutical giant Novo Nordisk A/S fell 4%.

Chart: Eli Lilly’s Worst Session In Over Three Years

Image: Benzinga Pro

Weight-Loss Market Sees New Entrants

“This week is a prime (early) example of why biotech risk needs to be managed and why a Magnificent 7 approach to biotech doesn't work,” Maurits Pot, founder and CEO at Tema ETFs, exclusively told Benzinga.

The two weight-loss giants have seen their duopoly position threatened by the entry of new players. First, Pfizer Inc. PFE and then Roche Holding Ltd RHHBY announced advancements in the development of obesity-fighting drugs.

However, Pot shows cautiousness in these early findings. “The initial Roche data on oral small molecule GLP-1 agonist was encouraging but important to note the patient size was only 25, we expect further details in an upcoming medical meeting,” Pot stated.

“Pfizer has had a number of prior setbacks with the early danuglipron formulation,” he said. This development suggests that Pfizer will now compete closely with Chugai Pharmaceuticals, the first-mover with its oral nonpeptide GLP-1 agonist, orforglipron, which sets a high bar.

“Pfizer’s focus on danuglipron is likely to temper any immediate interest in GLP-1 mergers and acquisitions,” Pot added.

Pot also foresees further developments from other companies, including AstraZeneca plc AZN, indicating that the GLP-1 market could eventually include up to five credible players alongside Novo and Lilly.

Diversification Is Crucial In This Industry

Since the inception of the Tema GLP-1, Obesity and Cardiometabolic ETF HRTS fund, Tema has consistently believed that the fast-evolving “GLP-1 market won’t be dominated by just two players.”

Pot explained that the HRTS portfolio reflects this conviction, maintaining decent exposure to both NOVO and LLY while avoiding overly concentrated positions of 30-40% in these companies.

“The HRTS portfolio leverages Tema's deep biotech expertise to identify early emerging next-generation GLP-1 players beyond NOVO and LLY,” the expert said.

Pot highlighted that Tema has been an early investor in several next-generation GLP-1 players such as Amgen Inc. AMGN, Terns Pharmaceuticals Inc. TERN, Chugai, Zealand Pharma A/S ZLDFF, and Viking Therapeutics Inc. VKTX.

Now Read:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.