D-Day has dawned as the U.S. goes to midterm polls on Tuesday, with all 435 House seats and one-third of the 100 Senate seats up for grabs, along with 36 gubernatorial posts.

What Happened: Early voting, through early in-person and/or mail-in, has already begun in some states and about 44.16 million votes were cast nationally, according to NBC News.

It could take anywhere between a day and several days before a clear picture emerges of whether the Republicans or Democrats would control Congress.

Polls have shown that Republicans are widely expected to wrest back the House, which is currently controlled by the Democrats with a slim majority. And the fate of a Senate majority hangs in limbo.

See Also: Is The Stock Market Open On Voting Day 2022? Here Are The Details

The odds of Republicans winning both chambers are 57 in 100, according to the latest predictions by FiveThirtyEight. The opinion poll analytics firm puts the odds of the Democrats retaining the Senate and Republicans taking the House at 27 in 100.

Drawing precedence from history, LPL Financial chief equity strategist Jeffrey Buchbinder said new presidents have always lost House seats during midterms, adding that since 1914, new presidents have lost an average of 30 seats and have picked up seats only twice.

The analyst also noted that incumbent President Joe Biden’s approval rating languishes, sitting at about the same level as former President Donald Trump’s when he faced a wave election.

Republicans are favored to pick up 15-20 seats, or 10-15 more than required to get a majority in the House, Buchbinder said.

Out of the 35 Senate seats up for election this year, 21 are held by Republicans and 14 by Democrats, he noted. Most of these seats are safe on both sides, with three seats — a Republican seat in Pennsylvania and two Democratic seats in Georgia and Nevada — close to being a tossup, Buchbinder added.

“Whoever wins two out of three probably takes control of the Senate,” the analyst said.

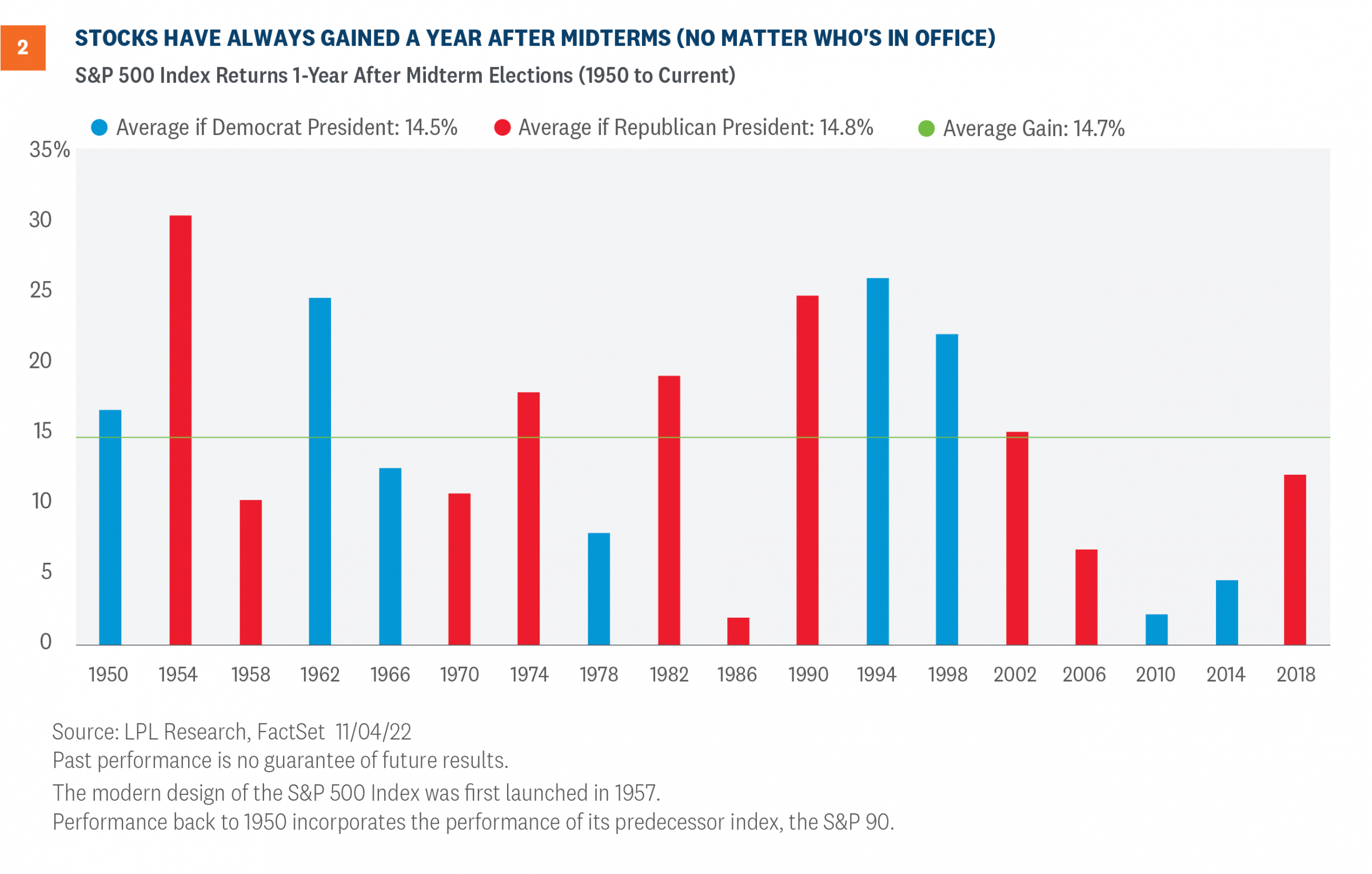

Takeaway For Markets: Markets historically do well in the year after the midterms, Buchbinder said, noting that they have been higher 18 out of the 18 times following the year, dating back to 1950. The average one-year return following midterms is 14.5% if the president is a Democrat and 14.8% if the president is a Republican.

Source: LPL Financial

Giving the rationale for the outperformance, Buchbinder said the upside could be due to the fact that the uncertainty surrounding the election was now in the rearview and the view that midterms usually provide something of a “course correction” from presidential elections. Markets may brace for a better policy balance, he added.

Dating back to 1951, a Democratic president with a Republican Congress or a split Congress – the two most likely outcomes in 2022, has resulted in an S&P 500 Index return of over 17% compared to an overall average of just over 12%, the analyst said.

The policy impact, according to Buchbinder, is likely to be small, as market participants stay focused on central bank policy and inflation.

Price Action: The SPDR S&P 500 ETF Trust SPY, an exchange-traded fund tracking the performance of the broader S&P 500 Index, settled Monday’s session down 0.96% at $376.95, according to Benzinga Pro data. The ETF had lost about 19% year-to-date.

Read Next: Investing For Beginners

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.