As the day concludes, Matthews International MATW is preparing to distribute a dividend payout of $0.24 per share, resulting in an annualized dividend yield of 2.82%. This payout is exclusive to investors who held the stock before the ex-dividend date on February 02, 2024.

Matthews International Recent Dividend Payouts

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2024-02-02 | 4 | $0.24 | 2.82% | 2024-01-24 | 2024-02-05 | 2024-02-19 |

| 2023-11-24 | 4 | $0.24 | 2.46% | 2023-11-15 | 2023-11-27 | 2023-12-11 |

| 2023-08-04 | 4 | $0.23 | 1.92% | 2023-07-26 | 2023-08-07 | 2023-08-21 |

| 2023-05-05 | 4 | $0.23 | 2.54% | 2023-04-26 | 2023-05-08 | 2023-05-22 |

| 2023-02-03 | 4 | $0.23 | 2.54% | 2023-01-25 | 2023-02-06 | 2023-02-20 |

| 2022-11-25 | 4 | $0.23 | 3.3% | 2022-11-16 | 2022-11-28 | 2022-12-12 |

| 2022-08-05 | 4 | $0.22 | 3.27% | 2022-07-27 | 2022-08-08 | 2022-08-22 |

| 2022-05-06 | 4 | $0.22 | 2.97% | 2022-04-28 | 2022-05-09 | 2022-05-23 |

| 2022-02-04 | 4 | $0.22 | 2.59% | 2022-01-27 | 2022-02-07 | 2022-02-21 |

| 2021-11-26 | 4 | $0.22 | 2.28% | 2021-11-17 | 2021-11-29 | 2021-12-13 |

| 2021-08-06 | 4 | $0.21 | 2.55% | 2021-07-28 | 2021-08-09 | 2021-08-23 |

| 2021-05-07 | 4 | $0.21 | 1.99% | 2021-04-28 | 2021-05-10 | 2021-05-24 |

With a dividend yield that places it neither at the top nor the bottom, Matthews International finds itself in the middle among its industry peers, while Civeo CVEO boasts the highest annualized dividend yield at 4.42%.

Analyzing Matthews International Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

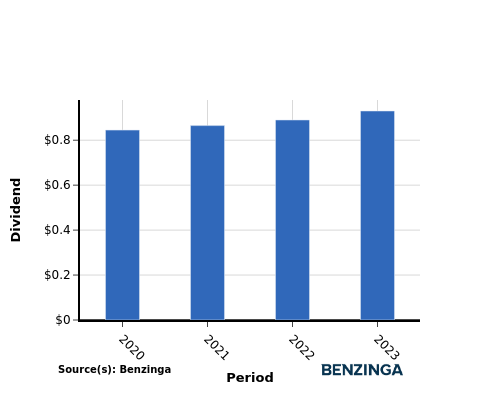

YoY Growth in Dividend Per Share

From 2020 to 2023, the company's dividend per share showed a positive trend, increasing steadily from $0.84 in 2020 to $0.93 in 2023. This demonstrates the company's commitment to rewarding shareholders by consistently raising dividends.

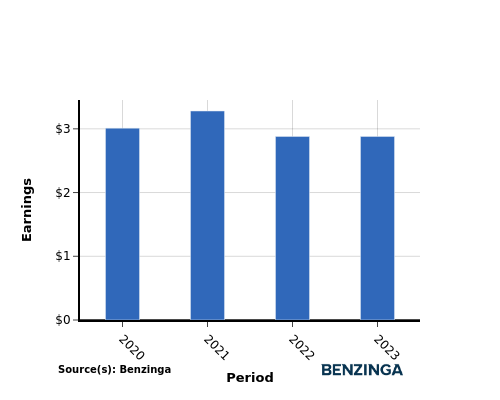

YoY Earnings Growth For Matthews International

From 2020 to 2023, Matthews International experienced a decrease in earnings per share, dropping from $3.01 to $2.88. This declining earnings trend may be worrisome for income-seeking investors, as it indicates a potential impact on the company's ability to sustain or increase its cash dividend payouts. Further analysis is necessary to understand the underlying reasons for this decrease.

Recap

This article provides an in-depth analysis of Matthews International's recent dividend distribution and the impact it has on shareholders. The company is currently distributing a dividend of $0.24 per share, resulting in an annualized dividend yield of 2.82%.

With a dividend yield that places it neither at the top nor the bottom, Matthews International finds itself in the middle among its industry peers, while Civeo boasts the highest annualized dividend yield at 4.42%.

The rising dividend per share and declining earnings per share of Matthews International from 2020 to 2023 indicate a deliberate choice to prioritize dividend distribution over earnings performance.

Investors should closely follow the company's performance in the coming quarters to stay up-to-date on any shifts in financials or dividend disbursements.

[See current stock movements Matthews International on Benzinga.](https://www.benzinga.com/quote/Matthews International (NASDAQ: MATW))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.