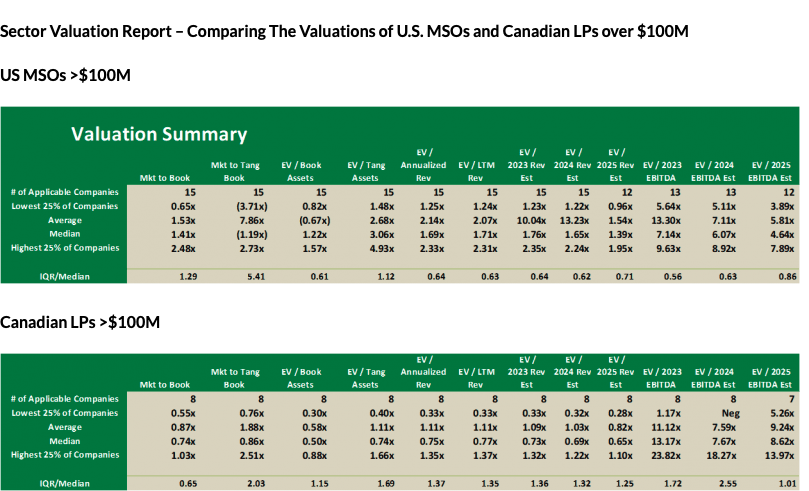

Viridian Capital Advisors has released a report comparing the valuations of U.S. multi-state operators (MSOs) and Canadian licensed producers (LPs) with market caps over $100 million.

The report reveals that Canadian LPs enjoy significantly higher valuations compared to their U.S. counterparts, despite often not producing any net income. For investors interested in the cannabis industry this discrepancy raises a question: what’s going on?

Understanding Valuation Metrics

Valuation metrics such as enterprise value (EV) to EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and EV to revenue are a way to understand how a company is valued relative to its earnings and sales. These metrics help investors determine if a stock is overvalued or undervalued and thus decide on investment actions.

According to Viridian’s tracker, the median EV/2024 EBITDA for Canadian LPs is significantly higher than that of U.S. MSOs. This means that investors are willing to pay more for each dollar of EBITDA generated by Canadian compared to U.S. companies.

But the fact is that U.S. MSOs are more profitable, yet have lower valuations. One way to understand this is by comparing EBITDA/revenue ratios. For 2025, the median EBITDA/revenue ratio for U.S. MSOs is 35.6%, whereas it is only 7.5% for Canadian LPs.

Read Also: Does Size Matter? These Two Small-Cap Cannabis Stocks Are Masters Of Cash Flow And Credit Management

Reasons For Discrepancy

One explanation for the higher valuations of Canadian LPs could be their potential for profitability improvement. However, this seems unlikely as the trend has been the opposite for years. A more plausible explanation is the access Canadian LPs have to a broader group of investors and higher liquidity in their stock trades. Canadian companies can attract more capital, making their stocks more liquid and therefore attractive to investors. Also, Canadian companies can gather capital easier in order to manage extended periods of net losses and sinking earnings performance than US companies.

Cannabis MSOs: Potential For Growth

The fact that Canadian as compared to U.S. companies are highly evaluated leads Viridian Capital experts to suggest that there’s room for growth within the sector in the US. Cannabis MSOs could see significant valuation improvements amid regulatory changes. The combination of a reclassifying cannabis to a Schedule 3 and potential of passing the SAFER Banking act, which could allow for up-listings on major stock exchanges all combine to be a game-changer. Schedule 3 would bring the removal of the 280E tax burdens, while SAFER (or a legislative alternative) would improve liquidity and funding, which is much needed in the industry. Together, these changes could position U.S. MSOs to trade more favorably and attract a broader investor base making the companies’ valuations closer to their peers across the border.

Some might say the time to invest in US. cannabis stocks is now.

- Read Next: U.S. Inflation Drop Paves Way For Federal Reserve Rate Cuts: Will Cannabis Stocks Benefit?

These issues will be a hot topic at the upcoming Benzinga Cannabis Capital Conference in Chicago this Oct. 8-9. Join us to get more insight into what the wave of weed legalization means for the future of investing in the industry. Hear directly from top executives, investors, advocates, and policymakers. Get your tickets now before prices go up by following this link.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.