'This Is Not The Market Participant's Problem': Volatility Arbitrage Trader Talks GameStop, Market Microstructure, Regulation

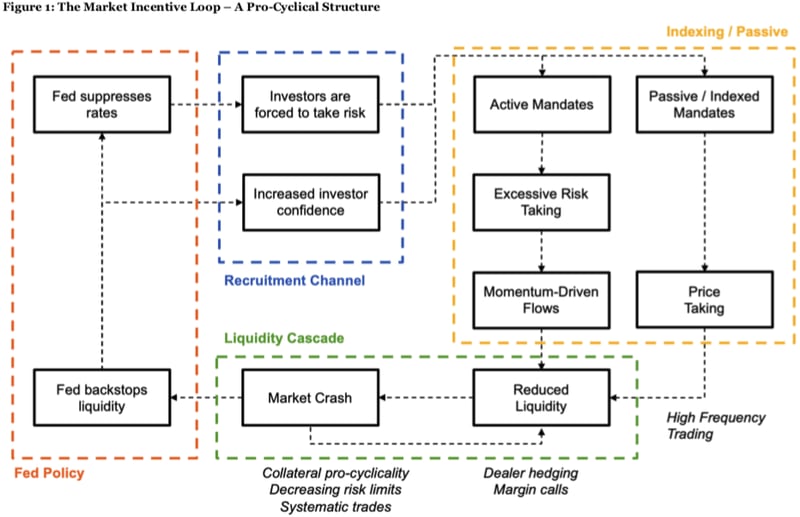

The dynamics that transpired in GameStop can be traced back to factors like Federal Reserve stabilization efforts and low rates, which incentivize risk taking.

“The growth of structured products, passive investing, the regulatory standpoint that’s been implemented with Dodd-Frank and dealers needing to hedge off their risk more frequently than not” are all part of a regime change that’s affected the stability of markets, said Kris Sidial, co-chief investment officer of The Ambrus Group.

“These dislocations happen quite frequently in small windows, and it offers the potential for large outlier events,” like the equity bust and boom of 2020, he said.

“Strength and fragility are two completely different components. The market could be strong, but fragile.”

The aforementioned dynamics of dealers’ risk exposure to direction and volatility causes violent crash dynamics to transpire.

In February 2020, one-sidedness in the market by yield-seeking participants like target date funds — such as mutual funds — selling far out-of-the money puts on the S&P 500 exacerbated volatility. So did customers looking to buy puts in an increasing fashion for downside exposure.

“We’re in there buying puts, dealers are short puts and short stock,” Sidial said in a discussion on rising delta and volatility forcing dealers to sell into weakness to hedge.

“As people reach for those downside puts on SPX, it now reflexively has another implication on increasing volatility. Well, all those people that are carrying short volatility exposure in their book are losing money.”

In all, a new regime with knock-on effects is forming solely due to positioning in the market.

PayPal-Owned Venmo To Add Crypto, Savings, Deal-Finding Functionalities

Venmo is a holistic platform for payments and money transfers.

As part of a vision to unlock access to fast and easy mobile payments, the company’s parent announced it would amp up innovation around the platform, adding cryptocurrency; the ability to save money; and to stay in the know on shopping deals through integrated tools from Honey, a platform for savings, deals and rewards.

"We all know the current financial system is antiquated, and we can envision a future where transactions are completed in seconds, not days; a future where transactions should be less expensive to complete; and a future that enables all people to be part of the digital economy, not just the affluent," PayPal CEO Daniel Schulman said.

"We are significantly investing in our new crypto, blockchain, and digital currencies business unit in order to help shape this more inclusive future."

Commission-Free Tastyworks Adds Crypto To Platform For Active Traders

tastyworks is a product of tastytrade, a holistic platform dedicated to challenging investors to think and trade strategically.

In light of the digital disruption in traditional finance, tastytrade is unlocking trading access to Bitcoin, Ethereum, Litecoin and Bitcoin Cash, cryptocurrencies with a combined market capitalization of over $735 billion.

“The recent surge in the prices of crypto like Bitcoin and Ethereum has increased customer interest in trading them,” said Scott Sheridan, CEO of tastyworks.

“Our development team has built what we feel is one of the most secure, low-latency, and reliable digital asset order routing and execution systems out there. And most important, it lets our clients buy and sell them and monitor their positions alongside their stocks and options. We are the first major brokerage firm to offer this.”

After requesting approval, tastyworks investors will be able to buy and sell cryptocurrencies directly from their equity accounts, unlocking a new level of portfolio diversification.

Metromile Taps Uber Veteran Ryan Graves For $50M, Guidance On Innovation

Metromile caters to non-traditional car owners, such as those that use transportation services like Uber Technologies Inc and Lyft Inc.

The company’s pay-per-mile auto insurance leverages big data and intelligent systems to tailor rates to driver behavior, resulting in lower premiums. Additionally, the company licenses out its core fraud, underwriting, and AI technology to help insurers automate and digitize their processes.

After partnering with INSU Acquisition Corp II, a SPAC sponsored by the insurance-focused Cohen & Company Inc, to become a publicly listed company that would trade on the Nasdaq Inc exchange under ticker “MILE,” the company added a $50 million investment from Ryan Graves, Uber’s former senior vice president of global operations, as well as the founder and CEO of Saltwater, an investment company.

As part of the development, Graves will join Metromile’s board of directors, assisting Chamath Palihapitiya’s Social Capital, Mark Cuban, and other leading institutional investors to support Metromile’s growth plans as a public company.

“Ryan has a remarkable reputation as an energetic and thoughtful business builder. His leadership and operating skills made Uber one of the fastest-growing companies of all time. As Metromile accelerates growth and scale, Ryan’s partnership will be immensely valuable to our Board and management team,” said Metromile Founder and Chairman David Friedberg.

“We are thrilled to have him become an owner in the business and sit side-by-side our Board and management team as we execute our growth plans as a public company.”

Entrepreneur And Media Personality Michael Gruen On The Power In Cold Emailing, Connecting

Too often, the value of cold emailing is discounted because the solicitor has no relationship with the audience, and there's no real-time feedback. However, cold emails are powerful. They helped Michael Gruen, an entrepreneur, angel investor, consultant and media personality, build his career and relationships, invest, as well as launch new companies.

“The value of the cold email is so underrated,” he said. “For example, I got a meeting with the chairman of NBC when I was like 15, just by cold email. From there, if they like you, and you do a good job, they’ll introduce you to others.”

Regardless of age and experience, when worded properly, cold emails are respected for being straightforward and unobtrusive.

“When you’re 13, and you’re writing emails and hustling, people pay respect to it. Also, I think people underestimate people’s desire to help.”

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.