Good Morning Everyone!

Remember, today at 2pm, a group of middle-aged financial experts determines whether or not millions of Robinhood traders get margin called.

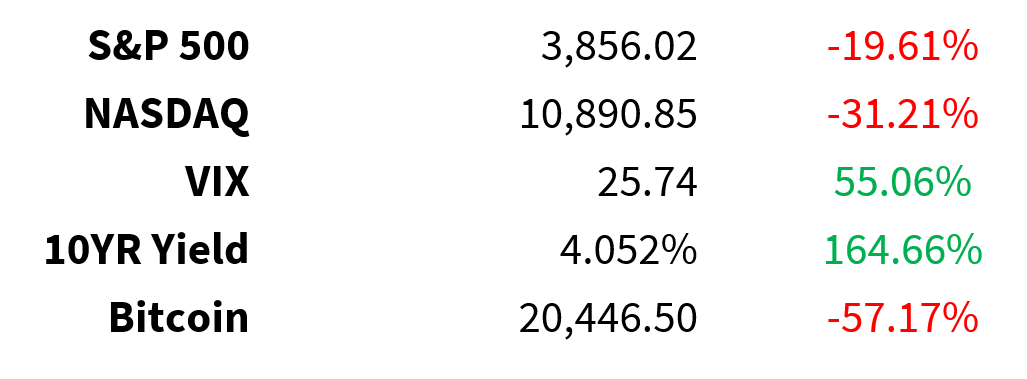

Prices as of 4 pm EST, 11/1/22; % YTD

MARKET UPDATE

2 p.m. Fed Reserve Rate decision

-

Volatility is relatively LOW heading into the Fed Meeting

-

4th straight rate hike of 75 basis points expected

-

More important: messaging on how the Fed proceeds from here

-

2:30 p.m. Powell press conference

-

Will Powell say: we are not done

-

Powell can’t be happy about the spectacular rally in the DOW in October / this is not what Powell wants

China orders a 7-day lockdown of iPhone City (Foxconn’s main plant in Zhengzhou)

-

Foxconn had a Covid flare-up that forced 200,000 staff into quarantine

-

Lockdown will last until November 9

-

The abrupt action reflects Beijing’s Covid Zero approach

-

Apple AAPL pre-market is down 1%

Russia

-

said it would resume participation in the Ukrainian grain deal

-

Wheat down 6%, Corn down 2%

Crude 88 flat

-

API Crude and product inventories out last night had little impact on Crude

-

Fed Day is more important

Maersk container vessels

-

A bellwether for global trade

-

Believes global demand will shrink by 4% in 2022 and will be down in 2023

Amazon AMZN hit a new year-to-date low yesterday

-

Amazon paused hiring in their Ad business

-

Any cost cutting measures will be viewed positive by investors

Autos

-

U.S. supply 32 days 18 month high

-

U.S. SAAR 15.3 million units 17 month high

-

Incentives were down 47% year-over-year but up 2.7% month-over-month

-

Inventory days supply is 32 days vs. 30 days last month and 23 days last year

-

Mix remains strong favouring trucks: Car vs. light truck mix at 21% / 79%

Opioid Settlement

-

Final settlement positive for pharmacies

-

$12-13.8 billion for the big three retail pharmacies

-

$21 billion announced in 2021 for the big 3 distributors

-

CVS CVS + 2%

-

Walgreens Boots Alliance WBA +2%

-

Walmart WMT flat

Earnings

-

Advanced Micro Devices AMD

-

Mondelez MDLZ

-

Airbnb ABNB beat but guide below street

-

McKesson MCK

-

Public Storage PSA

-

Devon Energy DVN Earnings and FCF beat, capex below consensus

-

AIG AIG EPS beat

-

Prudential PRU EPS beat

-

Energy Transfer ET

-

CVS Health CVS agreed to pay $5 billion to settle opioid lawsuits

-

Estee Lauder EL -8%, guide down to 2023

-

Progressive Insurance PGR

-

Humana HUM

CRYPTO UPDATE

International regulation

-

G-20 will prioritize crypto regulation

-

Third objective of India’s G-20 presidency

-

Year-long presidency

-

Takes over starting in December

-

-

Hong Kong warming up to crypto

-

Exploring giving access to retail crypto trading and ETFs

-

Considering range of pro-crypto measures

-

Mainland China much more strict

-

Blanket ban on all crypto in September 2021

-

-

Recent crypto trademark filings

-

Visa V

-

PayPal PYPL

-

Western Union WU

-

Viking Cruises

-

Ulta ULTA

-

Del Monte FDP

-

Kraft KHC

-

Inn-N-Out

-

Takis

-

Moët Hennessy

-

Formula One

-

DraftKing DKNG

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.