Back from vacation and diving into a big week. The S&P 500 is just over 5% away from hitting its all-time high, FED's poised for a rate hike, second quarter GDP and big tech earnings are rolling in. Coffee in hand? Let's conquer this week together!

Market

Prices as of 4 pm EST, 7/21/23

Macro

Institutional investors have never been more bearish on the US dollar.

-

Net short positions on USD jumped by 18% last week.

-

Driving the sentiment is continued progress on the inflation front.

-

Improving inflation means a less hawkish Fed which could pose a significant headwind for the dollar.

-

All eyes will be on the Fed’s next move.

Speaking of, the Fed will make its interest rate decision on Wednesday afternoon.

-

With markets placing a 99.8% chance on a 25bps rate hike, investors will be parsing Powell’s words for clues on future policy.

-

Following this week’s hike, markets expect the Fed funds rate to remain at 5.25-5.50% through Q1 2024.

-

The first cut is seen happening in March:

CME Group

Stocks

After 3 straight weeks of inflows, US equity funds saw $2.3 billion in outflows last week.

-

Money still found its way into Tech, Financials, and Consumer Goods.

-

In terms of positioning, investors are overweight Staples, Tech, and Telecom.

-

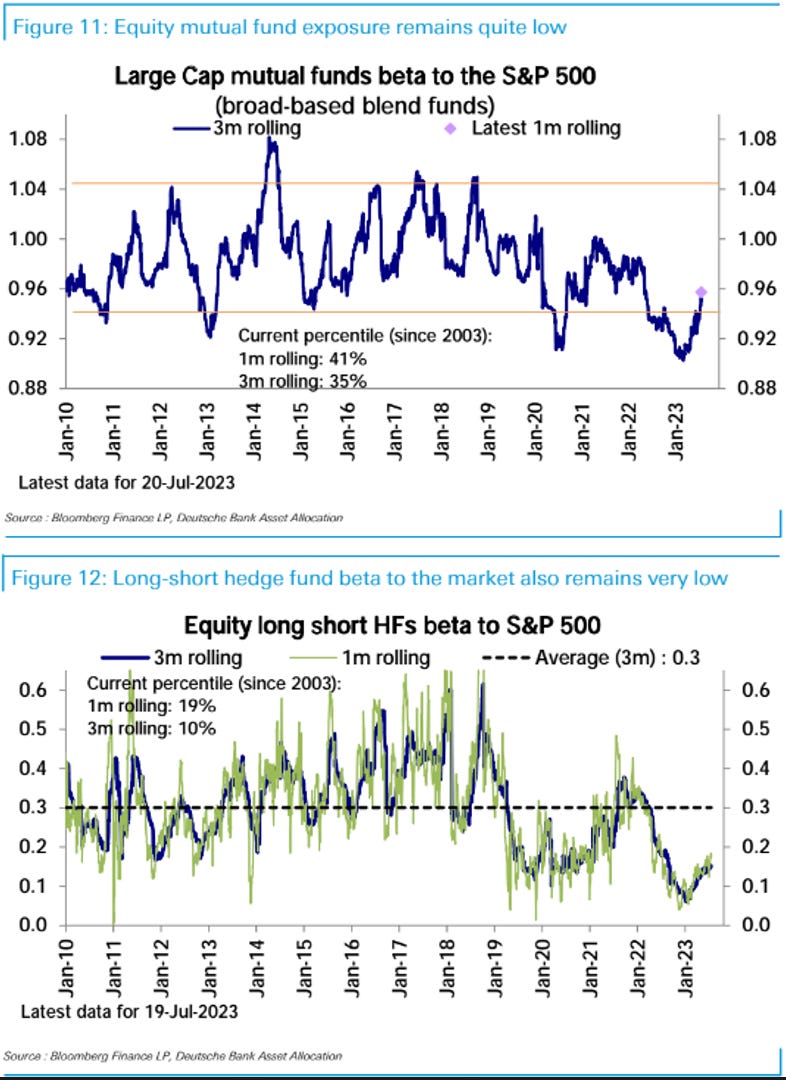

Aggregate positioning in equities is in the 82nd percentile, according to Deutsche Bank, led by discretionary investors.

-

Still lagging in exposure: hedge funds and mutual funds.

Deutsche Bank

With leadership at its narrowest in 30 years, the current rally’s breadth is worse than that of the Dotcom Bubble, according to JPMorgan.

-

But bad breadth could be masking hidden opportunities.

-

Goldman calculates the aggregate forward P/E of the “Magnificent 7” at 32x, putting the overall index at 20x.

-

Beneath those 7, the bottom 493 carry a 17x multiple.

-

Will the laggards close the gap?

Goldman Sachs

Energy

Goldman Sachs and JPMorgan are predicting higher oil prices ahead.

-

The former sees demand growing to all-time highs and a significant deficit in the second half.

-

Both expect Brent to end the year at $86 a barrel:

JPMorgan

Earnings

Q2 earnings season update:

-

18% of S&P 500 companies have reported.

-

75% and 61% of companies have topped earnings and revenue estimates, respectively.

-

Sectors reporting EPS growth: Discretionary, Communications, Industrials, Real Estate, Financials, Staples

-

Sectors reporting sales growth: Financials, Discretionary, Healthcare, Staples, Real Estate, Industrials

-

Blended earnings have dropped 9% while revenue has declined by 0.3%:

Fact Set

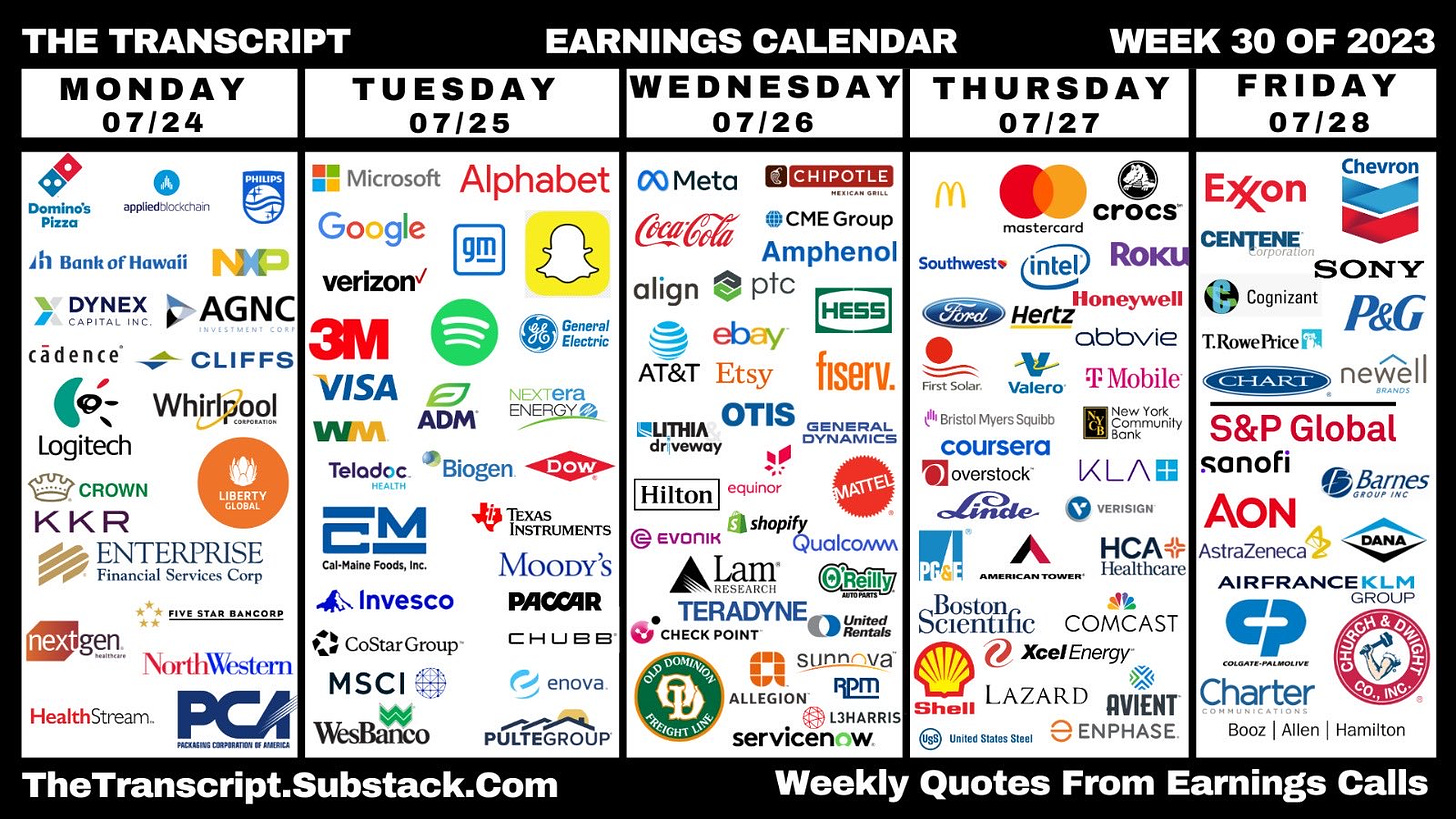

What we’re watching today:

-

Cadence Design Systems CDNS

-

NXP Semiconductors NXPI

-

Alexandria Real Estate ARE

-

Brown & Brown BRO

-

Domino’s Pizza DPZ

-

Packaging of America PKG

-

Crown Holdings CCK

-

Logitech LOGI

Top Headlines

-

UK slowdown: Rising interest rates are hitting consumer spending and manufacturing in the UK.

-

Japan inflation: The BOJ may be increasing its inflation forecast to 2.5% from 1.8%.

-

Foreign investment: Chinese investment in the West has been slowing.

-

Housing rally: Robert Shiller says the 10-year rally in US home prices could be ending.

-

Crisis averted: Yellow struck a deal with 22,000 of its Teamsters-represented workers to avoid a strike.

-

Barbenheimer: Barbie and Oppenheimer brought in a combined $235 million at the box office over the weekend.

-

RIP Twitter: Musk has rebranded Twitter as “X”.

-

Market narratives: These are the 2 competing market narratives according to Apollo’s Torsten Slok.

Week Ahead

-

Monday: Chicago Fed National Activity Index, S&P Global Flash PMIs

-

Tuesday: Redbook, Case-Shiller Home Prices, House Price Index, CB Consumer Confidence, Richmond Fed Manufacturing/Services Indexes, API stocks change

-

Wednesday: MBA mortgage data, new home sales, EIA stocks change, Fed decision

-

Thursday: GDP growth rate, Durable Goods orders, goods trade balance, initial jobless claims, retail/wholesale inventories, pending home sales, Kansas City Manufacturing

-

Friday: Personal income/spending, PCE Price Index, Employment Cost Index, consumer sentiment

-

Crypto

Prices as of 4 pm EST, 7/21/23

-

HODL: Some 75% of Bitcoin’s BTC/USD circulating supply is controlled by long-term holders.

-

BTC vol: Bitcoin’s 30-day volatility is at its lowest since mid-January.

-

Risk-averse: Activity in futures markets suggests Bitcoin traders remain cautious.

-

Worldcoin: Sam Altman’s Worldcoin launched its WLD token today which investors have met with open wallets.

-

XRP ruling: An SEC appeal in its case against Ripple doesn’t appear to represent a significant setback for the ruling.

Deals

-

Shadow bank: Bain Capital will buy Gautam Adani’s stake in his shadow bank.

-

Investment banking: While big Wall Street firms downsize, smaller players are bulking up.

-

M&A traders: Merger arbitrage is among this year’s worst-performing hedge fund strategies.

-

Aerospace: Safran will buy Collins Aerospace’s flight controls business for $1.8 billion in cash.

-

ESPN search: In its search for a strategic partner, ESPN has talked with the NBA, NFL, and MLB.

Meme Of The Day

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.