The crypto market has been at a peak this year, driven primarily by Bitcoin's BTC/USD remarkable performance, which has recently crossed the ATH price of $70,000. Analysts and investors attribute Bitcoin’s current bullish trajectory to the highly anticipated halving event slated for April.

As the next halving event approaches, concerns about its impact on miners and mining operations are on the rise. Many worry about potential miner exodus due to the expected 50% reduction in mining rewards, which could negatively affect profitability. Additionally, there are fears of a downturn in Bitcoin's price post-halving.

But do these concerns have all the grounds? A thorough examination of historical price patterns and ecosystem dynamics suggests they might be exaggerated. The analysis also presents alternative strategies miners can utilize to navigate potential risks as we approach the upcoming halving event.

Bitcoin Halving and Its Importance in the Ecosystem

Being just a few weeks away, the 2024 Bitcoin halving is currently a major talking point among Bitcoin investors and the broader crypto market. But what's the big deal about halving, you might ask?

Well, imagine this: Every time you send Bitcoin, your transaction gets added to a block and handed off to a miner for validation. Once successfully added to the Bitcoin chain, the transaction gets the green light, and a tip reward gets added on top of the fixed block reward of 6.25 BTC per block.

Now, here's where halving comes into play. Satoshi Nakamoto, the mastermind behind Bitcoin, introduced halving to keep the supply of new Bitcoins in check and prevent price inflation. This reduction in mining rewards happens roughly every four years to maintain Bitcoin's value. That means miners’ block rewards will reduce to 3.125 BTC after this year’s halving.

This reduction in rewards is expected to significantly cut the profitability of miners, and analysts believe it may push many of them to exit the Bitcoin network. Furthermore, they could seek alternative income sources and strategies for stable operations.

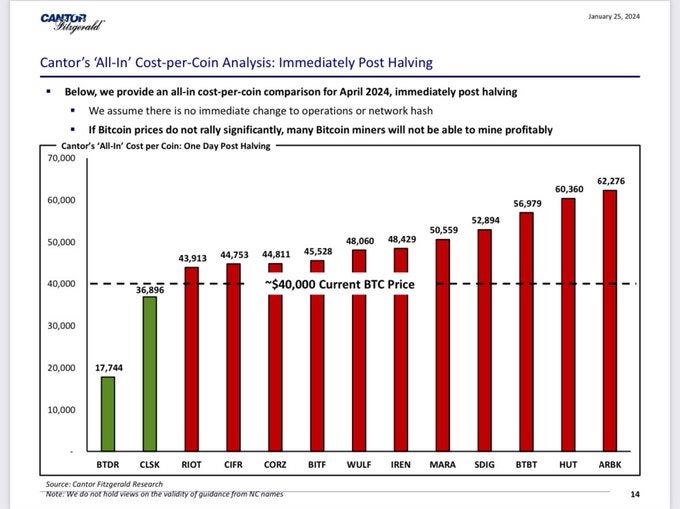

Source: Cantor Fitzgerald

And the concerns are valid, considering the growing operating costs miners face. From purchasing and maintaining mining hardware to covering electricity bills, the expenses can add up quickly. Since miners play a crucial role in the Bitcoin network's integrity, any significant reduction in their numbers could have far-reaching implications for the whole market. Cantor Fitzgerald report data suggests that April’s halving can make 11 largest miners unprofitable at a BTC price of $40,000 as the cost of mining 1 BTC for them will be higher than the actual market price.

Matthew Schultz, co-founder of the mining firm CleanSpark, suggests that the most vulnerable are the British company Argo Blockchain ARBK and the American Hut 8 HUT. After halving, the cost of bitcoin mining for these companies will be $62,276 and $60,360, respectively. At the same time, at current prices in the region of $40,000, only Bitdeer BTDR (Singapore) and its company CleanSpark CLSK (USA) will be able to support their business.

History Doesn’t Predict a Bitcoin Decline

Despite these challenges, historical price data tells a different story. After each halving event, Bitcoin's price has experienced a significant surge. This growth typically begins months before the halving and intensifies afterwards.

In 2012, following the first halving, Bitcoin's price skyrocketed from $13 to over $1,100 within 12 months, despite the block reward dropping from 50 BTC to 25 BTC.

Similarly, before the 2016 halving, Bitcoin's price hovered around $660, then surging to $17,000 in the months following the event. The reduction in rewards from 25 BTC to 12.5 BTC did not directly impact the coin's value.

In 2020, despite the block rewards decreasing from 12.5 BTC to 6.25 BTC, Bitcoin's value surged from around $9,700 before halving to over $67,000 the following year.

Bitcoin’s Potential Growth Keeps Fears at Bay

Experts are optimistic about Bitcoin's future after the 2024 halving, expecting the cryptocurrency to reach new highs. The optimism follows the US Securities and Exchange Commission's approval of spot Bitcoin exchange-traded funds (ETFs). Such regulatory clearance makes the 2024 halving a pivotal event for Bitcoin's future.

With the majority of predictions suggesting Bitcoin price might reach up to $200,000 this year, it’s unlikely that miners will bail out since they will capitalize on the cryptocurrency growth for more profits. Mining companies who have been working in the market for years have a solid amount of BTC in their portfolio, which allows them to hedge risks in case of negative scenarios. Some cryptocurrency miners may prefer not to sell the mined coins at the current price and hold them in hopes of an increase in the rate. This will support the growth of the Bitcoin rate, as it will provoke a shortage of new Bitcoins on the market.

In addition to generally positive fundamental metrics, the post-halving market structure may look favorable for Bitcoin traders. Lower fees are expected to require relatively less buying pressure to maintain prices, which could push prices higher as demand increases. Grayscale estimates that with a current reward of 6.25 BTC per completed block and a Bitcoin price of $43,000, selling pressure from miners amounts to approximately $14 billion per year. This means that to maintain current prices, price support in the form of at least equivalent purchasing activity is required. If these requirements drop to $7 billion per year after the halving, it would significantly ease selling pressure.

Moreover, the recent Wall Street debut of the first Bitcoin-based spot exchange-traded funds (ETFs) could serve as a counterbalance to miners selling Bitcoin. “ETFs can significantly ease selling pressure, potentially changing the structure of the Bitcoin market and providing a new sustainable source of demand, which will have a positive impact on the price” the report said.

As a result of the halving, the reward for cryptocurrency miners for finding a block will be halved to 3,125 BTC, which will be paid by the network itself. However, miners’ income consists not only of these rewards, but also of the commissions that users pay for performing operations. Commissions vary depending on the congestion of the network and the demand for transactions, but the general trend in recent years demonstrates an increase in the share of commissions for transactions in the structure of income of cryptocurrency miners.

For example, in May 2023, the income of one of the cryptocurrency miners who mined block 788,695 consisted of more than half of transaction fees. For now, these are isolated cases, but over time, as network rewards decrease, cryptocurrency miners will rely more on transaction profits.

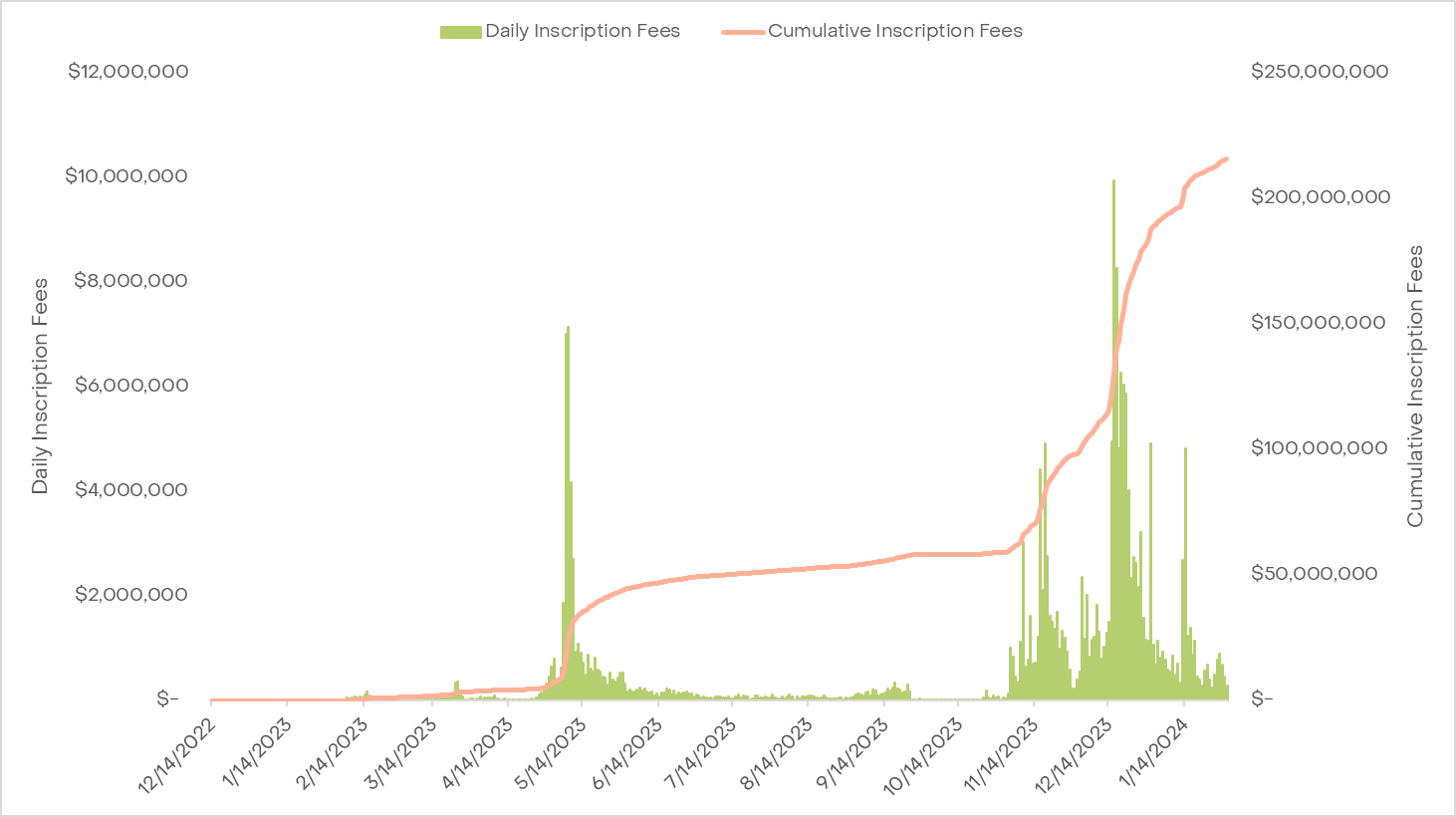

Moreover, there's an additional revenue stream for miners through transaction fees from Bitcoin Ordinals, adding another layer of profitability to their operations.

Bitcoin Ordinal Fees Generate $200 Million for Miners

Introduced in 2023, Bitcoin Ordinals revolutionized the Bitcoin network by enabling the creation and storage of digital assets like images and texts, akin to non-fungible tokens (NFTs) on the blockchain. Leveraging satoshis, the smallest unit of Bitcoin, these Ordinals have quickly become a good source of income for miners.

Since their inception, Ordinals have significantly contributed to miners' earnings. This is because users pay high transaction fees to inscribe Ordinals on the blockchain. For context, over $200 million in Ordinals transaction fees has been paid to Bitcoin miners, accounting for about 20% of their total transaction processing income besides mining rewards.

Though small-scale miners may struggle after the 2024 halving because of a sharp decline in profits, enterprise-level miners will potentially navigate the changes better. These industry giants will continue expanding their operations, expanding their networks, and seizing opportunities presented by potential post-halving Bitcoin price surges. They will also increase their profits by leveraging transaction fees from Bitcoin Ordinals.

With these strategies in play, Bitcoin mining remains a promising venture, offering sustained profitability for miners, particularly as the blockchain ecosystem continues to evolve.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.