Although Halloween is six weeks past, the witches are out on Friday. It’s quadruple witching day in the markets, when the expiry of a number of derivatives contracts can have an unnerving impact on trading.

Quadruple witching is the simultaneous expiry of stock options, index futures, index futures options and single stock futures contracts. The last of these hasn’t traded in the U.S. since 2020, so it’s now more accurately triple witching.

The event occurs quarterly on the third Fridays in March, June, September and December and can cause abnormal trading volumes and market volatility as derivatives traders rush to close out their contracts — often involving the purchases of large volumes of stocks to cover contract positions.

On Friday, just one hour after the market open, trading volume on the Dow was already nearly half of that of the previous session’s total — and Thursday’s total saw the largest volume of trade on the Dow since mid-September.

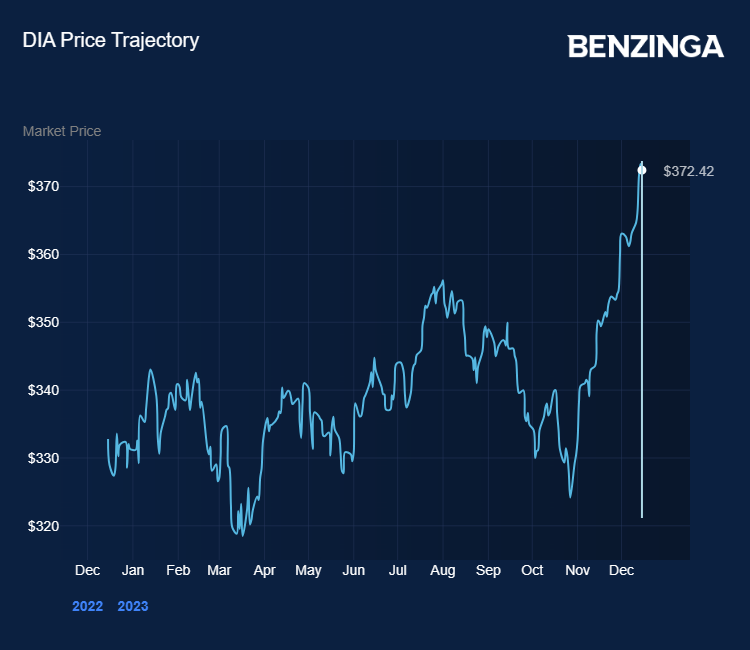

The SPDR Dow Jones Industrial Average ETF Trust DIA, an exchange traded fund that tracks the Dow, has also seen some heavy trading volumes recently. It is up 14.8% since the end of October.

Also Read: US Small Caps Streak Ahead: Interest Rate Euphoria Gives America’s Small Businesses A Boost

Imbalances And Rotation

“Most days you can look at pre-market imbalances and get a pretty good idea of where the market’s going to open. You can’t do that on a third Friday because they go all over the place and data is meaningless on this day,” Dennis Dick, CFA at Bright Trading, said Friday on Benzinga’s “Pre-Market Prep.”

Much of the trade associated with the witching events takes place in the final hour of trade, an hour when inexperienced traders should leave the floor.

In addition to the witching on Friday, Wednesday’s dovish pivot by the Federal Reserve was another momentous market event that could add to market volatility in coming days as traders who were positioned for a more hawkish outcome adjust their portfolios.

“We’re in so much rotation here right now, markets are adjusting for an accommodative Fed, and you can’t fight the Fed,” added Dick.

When Has Witching Had A Strong Market Impact?

Markets have seen some abnormal price movements on witching Fridays, but the biggest fallout came 36 years ago on a Monday.

Black Monday, October 1987: On Monday, Oct. 19, 1987, the Dow Jones Industrial Average lost 22.6% — the index’s biggest single-day decline since the Great Depression in 1929 — and was largely influenced by witching events that took place on the preceding Friday, Oct. 16.

After-hours settlements of futures and options contracts on that Friday resulted in stocks tanking in premarket trade in the following session, causing equity indices to tumble throughout what became known as Black Monday.

But barring a few price flutters, quadruple witching days now usually pass without much notice. That’s not to say, however, that traders couldn’t get spooked later on today.

Now Read: Will Unemployment Spike In 2024? History Of Fed Rate Cuts Would Suggest So

Photo via Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.