Stocks need a reason to move higher, and the market is running out of those reasons. Thus, Craig Johnson, chief market technician at Piper Sandler, believes a market correction is imminent.

“Some of the internal indicators that we produce have just given us a sell signal,” Johnson said on Monday, while appearing on Benzinga’s PreMarket Prep.

“When we’ve seen this signal in the past, it’s been a pretty good indication looking forward over the next three or four months — it could be just a pullback or a correction. But it’ll definitely be more than just noise,” he said.

Johnson noted three technical indicators, including a decline in the number of industry groups that were above their 40-week average, while the number of new highs among these groups peaked at the end of 2023.

“All of this happened as the market was working its way higher, so this market is really going up on bad breath,” he said.

“So, we’re saying: ‘You don’t have to let go, but hold on loosely.’ Be ready for a correction in this market that could probably take the S&P 500 back to about 4,600,” Johnson said, adding that the low is likely to come towards the end of March or early April, at which point the market will provide a better entry point.

Will There Be A Catalyst For A Correction?

Johnson said that earnings season and expectations of Federal Reserve interest rate cuts have been the catalysts for sending the market higher. While the catalyst for a correction, if inaction can be called such, will be the lack of positive drivers.

“We’ll be out of earnings season, and the Fed isn’t going to tell us anything new, probably until the May meeting,” he said.

This doesn’t mean, however, that Piper Sandler is turning negative on the market, Johnson said.

“We like the market longer term,” he said, but added he expected some rotation out of the tech mega caps, such as Amazon AMZN and Meta Platforms META towards financials and healthcare stocks.

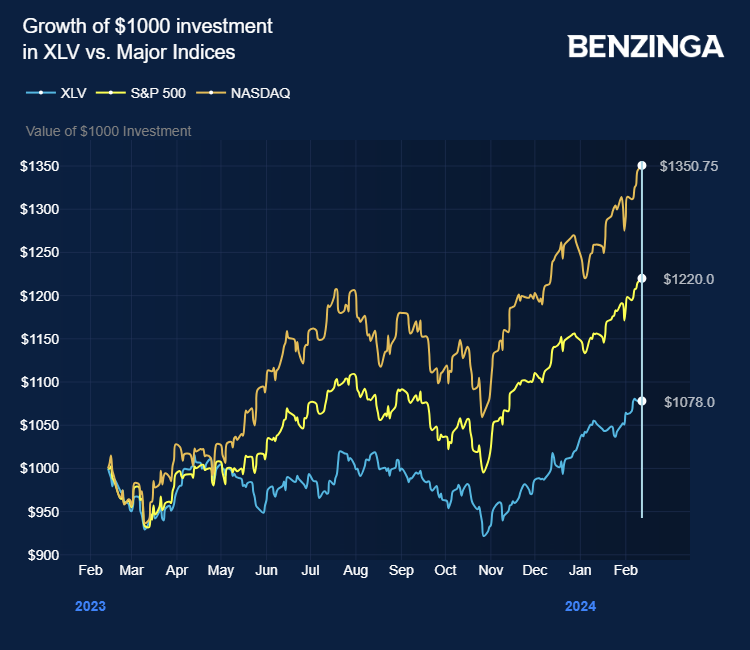

These are sectors that underperformed the main index in 2023. In 2023, the SPDR S&P 500 ETF SPY, an exchange trade fund that tracks the main index, gained 24%.

By contrast, the iShares U.S. Financial Services ETF IYG gained 13%, while the Health Care Select Sector SPDR ETF XLV gained just 0.4%.

Fed Rate Cuts Drive Small Caps Rally

Looking towards the timing of Fed rate cuts, Johnson said he expected June, rather than March or May, for the central bank’s first move.

This could be the spark for a rally in small- and mid-cap stocks as lower interest rates ease the burden on business loan repayments for smaller companies.

Johnson’s year-end target for the S&P 500 is 5,050 — that’s the base case, he says, as investors grapple with intermittent corrections and the distraction of the November election.

“Unless the market just wants to keep going higher — but that’s a really tough argument technically,” he said.

Johnson concluded: “I just don’t think today is when you put the pedal to the metal — this is where you pull it back a little and wait for this market to come back to you.”

A market correction is usually defined as when a stock index falls more than 10% from its most recent cyclical peak — that would be the fresh record high that the S&P 500 struck on Monday. A correction turns into a bear market when the index falls by more than 20%.

Now Read: These 4 AI-Related Stocks Outside Magnificent 7 Are Already Outperforming In 2024

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.