Former President and presidential candidate Donald Trump advocates for maximizing U.S. oil production, a stance seemingly shared by billionaire investor Warren Buffett. Buffett’s Berkshire Hathaway Inc. (NYSE: BRK-A) (NYSE:BRK-B), holding a significant share in Occidental Petroleum Corporation OXY, aligns with this perspective.

During his time in the Oval Office, Trump lifted many of the environmental-based regulations on the U.S. oil industry in an effort to promote energy independence and reverse years of dependence on foreign petroleum imports.

In his annual letter to investors, Buffett cheered the efforts of companies producing domestic oil projects, as they raised output from less than 10 million barrels per day in the 1970s.

Also Read: Biden The Master Oil Trader Part III? President Refills Emergency Stash As Crude Price Slides

Shale Production Comes Online

“For a long time, the pessimism appeared to be correct, with production falling to 5 million b/d by 2007,” Buffett explained.

“Meanwhile, the U.S. government created a Strategic Petroleum Reserve (SPR) in 1975 to alleviate — though not come close to eliminating — this erosion of American self-sufficiency,” Buffett continued.

“And then — Hallelujah! — shale economics became feasible in 2011, and our energy dependency ended.”

“Now, U.S. production is more than 13 million b/d, and OPEC no longer has the upper hand,” he added.

Berkshire Hathaway owns a 27.8% stake in Occidental Petroleum, a Houston-based multinational operator, with major shale production projects in the U.S. Permian Basin, as well as traditional drilling operations in the Middle East, Canada and Chile, and it has a major carbon recapture business.

In addition to its 27.8% stake, Berkshire Hathaway also owns warrants that, for more than five years, give it the option to further increase its ownership at a fixed price.

“We particularly like its vast oil and gas holdings in the United States, as well as its leadership in carbon capture initiatives, though the economic feasibility of this technique has yet to be proven. Both of these activities are very much in our country's interest,” said Buffett in the annual letter.

No Plans To Take Control

He added, however, that Berkshire Hathaway has no plans to “purchase or manage” Occidental.

“Under Vicki Hollub's leadership, Occidental is doing the right things for both its country and its owners,” said Buffett. Adding that he expected to maintain an investment in Occidental “indefinitely.”

“No one knows what oil prices will do over the next month, year, or decade. But Vicki does know how to separate oil from rock, and that's an uncommon talent, valuable to her shareholders and to her country.”

Berkshire Hathaway’s 27.8% stake in Occidental is worth, at today’s share price of $60, around $14.7 billion. The company also owns an $18.8 billion stake in Chevron Corp CVX.

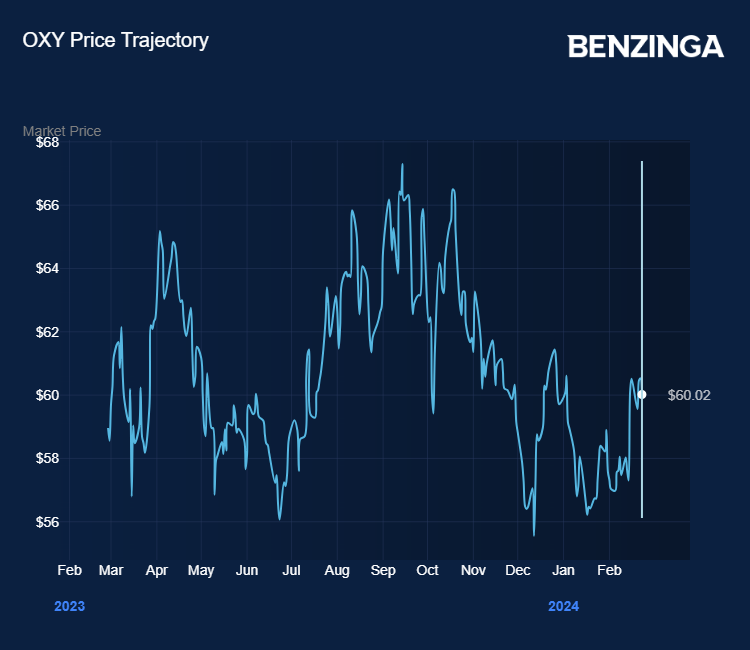

Despite Berkshire Hathaway’s ownership of a large slice of the company, Occidental’s shares have been volatile over the past couple of years, hitting a record high of around $113 back in 2011, and being largely stuck in a range between $60-$70 since the beginning of 2023.

Photo: Shutterstock and Fortune Live Media on Flickr

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.