Three people were reportedly killed and several others injured after an anti-ship ballistic missile launched by Iran-backed Houthi rebels in Yemen struck bulk carrier M/V True Confidence in the Gulf of Aden late on Wednesday.

The crew abandoned the Barbados-flagged, Liberia-owned vessel following the attack, which caused significant damage. At least three of the injured were reported to be in critical condition.

U.S. Central Command said on X that coalition warships were responding and “are addressing the situation.”

It added: “This is the fifth ASBM fired by Houthis in the last two days. Two of these ASBMs impacted two shipping vessels — M/V MSC Sky II and M/V True Confidence — and one ASBM was shot down by USS Carney.

“These reckless attacks by the Houthis have disrupted global trade and taken the lives of international seafarers.”

While the attacks have driven many freight carriers to avoid the Red Sea/Suez Canal/Mediterranean route to Europe and the U.S. east coast, some persist, as the alternative Cape of Africa route is longer and can add up to two weeks to a journey.

“This situation has led to an immediate contraction in market capacity and a surge in shipping rates, with significant impacts on global trade networks and economic stability,” said Zera Zheng, global head of business resilience consulting at Norwegian shipping giant Maersk, which has been avoiding the Red Sea since mid-December.

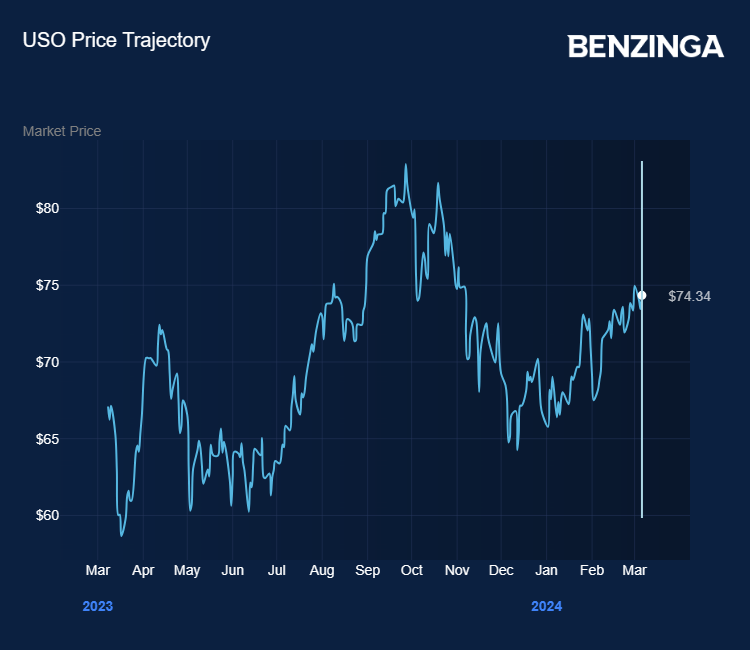

Oil Prices Creep Higher This Year

Oil prices haven’t responded violently, but the longer the war in Gaza continues to provoke antipathy towards Israel from the Middle East, oil prices have slowly risen back to four-month highs.

The United States Oil Fund USO, an exchange-traded fund that tracks U.S. oil prices, rose 1.2% to $74.34 on Wednesday but was down 0.6% in pre-market trade on Thursday. So far in 2024 it has risen 11.5%.

Gasoline prices are also rising, underpinned by the rise in crude. After falling to a three-year low in December, RBOB Gasoline futures are up 28.7% to their highest levels since October 2023.

The United States Gasoline Fund ETF UGA is up 16% over the same period. The U.S. average gas price at the pump has risen from $3.06 at the beginning of the year, to $3.40 on Wednesday, according to Gas Buddy.

Meanwhile, U.S. natural gas prices remain more than 5% over the week after EQT Corporation EQT, the largest producer announced on Monday it was slashing output due to low prices. The United States Natural Gas Fund ETF UNG showed a weekly gain of 5.5%.

Cease-Fire Talks Deadlocked

Back in the Gaza Strip, desperate civilians hoping for some relief from the shelling and fighting during the holy month of Ramadan, looked set to be disappointed, with cease-fire talks seemingly deadlocked.

The deal to release Israeli hostages held in Gaza by Hamas in exchange for a cessation in hostilities appeared to be at an impasse after Israel refused to send delegates to Cairo to join talks with Hamas and diplomats from Egypt, Qatar and the U.S.

Israel had previously said it would not join the Cairo talks without first being provided a list of the names of hostages — alive and dead — still being held by Hamas.

Fears are now growing that without a cease-fire by Ramadan, tensions could erupt across the Islamic Middle East. President Joe Biden said earlier this week that without a cease-fire by the start of the holy month, the region could become “very dangerous.”

Image: Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.