Stock trading by the members of Congress is often looked upon with suspicion, given the possibility that they may have privy to insider information, and a Democratic senator’s recent trades have come under the scanner.

What Happened: Sen. Tina Smith (D-MN) bought shares in Georgia-based Artivion, Inc. AORT on two days, mandatory Congressional disclosure made by the senator on Nov. 20 showed. The owner was mentioned as the spouse of the senator.

The “Stock Trading on Congressional Knowledge Act” requires U.S. Senators to publicly file and disclose any financial transaction within 45 days of its occurrence.

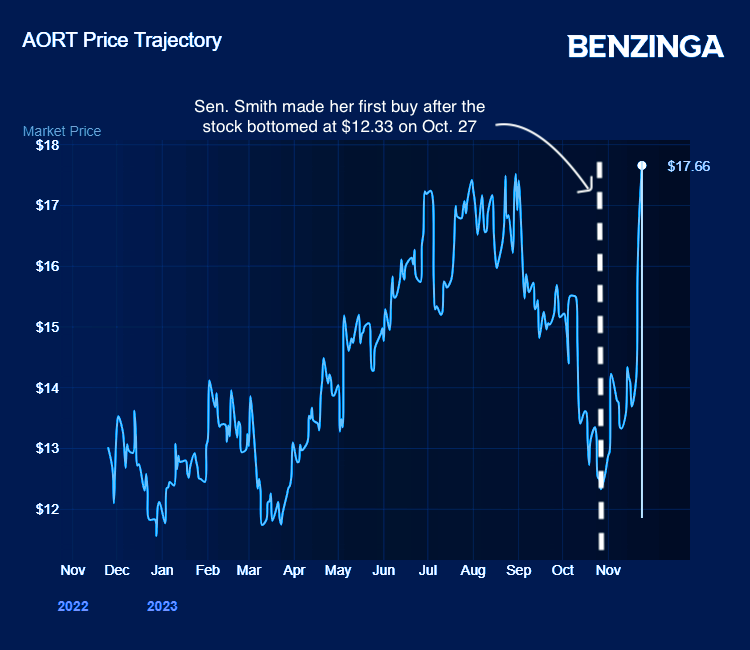

The senator’s spouse apparently bought shares valued between $50,001 and $100,000 on Nov. 10 and another tranche having the same value on Nov. 16. Artivion traded at $13.35 on Nov. 9, the session ahead of the senator’s first purchase of the stock for the year. Since then the stock has rallied 31.16% and settled Monday’s session at $17.51, according to Benzinga Pro data.

Chart Courtesy of Benzinga

See Also: Best Healthcare Stocks Right Now

Artivion is a medical device company manufacturing medical devices and implantable human tissues worldwide. Over the past five years, the stock has lost about 40%.

The company reported on Nove. 2 third-quarter results, which showed revenue rising 14.34% and the loss per share narrowing from 34 cents to 24 cents. On a non-GAAP basis, the company reported earnings of 2 cents per share. The company also nudged up its full-year guidance range.

Although the stock did react with a modest move to the upside immediately after the earnings, it began spiking sharply higher only on Nov. 21.

Assuming the Smith’s investment was at the upper end of the range, she would be in possession of $100,000 worth of shares since Nov. 10. At the session’s closing price of $13.33, the number of shares owned would have been 7,501 shares.

If the senator had purchased $100,000 shares on November 16, she would have been in possession of about 7,097 shares (based on November 16’s closing price of $14.09).

The total number of shares Smith possessed would be around 14,598 based on these assumptions. The value of the shares would be around $255,611 based on Monday’s closing price, which works out to a gain of $55,611 on an investment of $200,000.

Why It’s Important: Smith’s trading disclosure drew criticism, especially as she had voiced her support for the United Auto Worker‘s union in mid-October, when it was on a strike against Detroit’s Big Three automakers. Taking a swipe at corporate executives, she said, “If they have the cash to line executives' pockets then they can pay their workers what they deserve.”

In a post on X, formerly Twitter, Congresstrading.com, a forum that compiles data on trading by Congressmen said, “She profited up to $60,000 which is more than the American median yearly salary. Looks like she is lining her own pockets too.”

Former House Speaker Nancy Pelosi is famous for her stock trading, so much so that there is a tracker of her portfolio. The stock purchases made by her spouse often come under scrutiny especially due to the kind of regulatory information she has access to.

Image created using photos on Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.