The Nasdaq 100 closed higher by around 0.2% on Monday. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company's prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

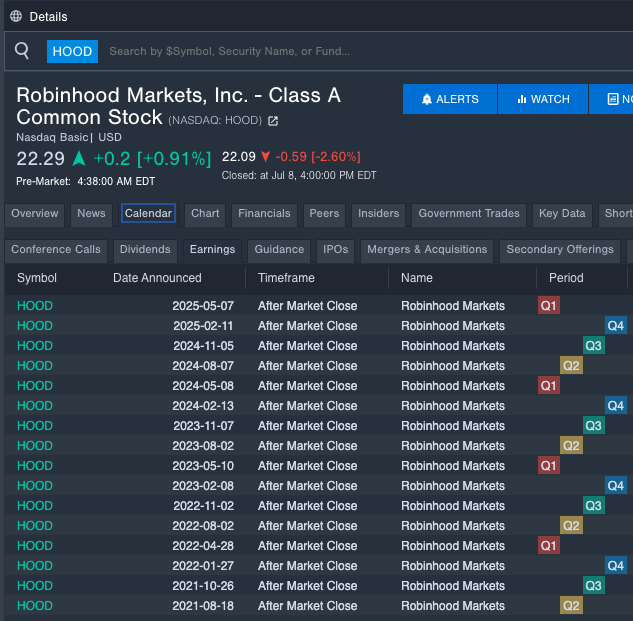

Robinhood Markets

- The Trade: Robinhood Markets, Inc. HOOD Chief Legal Officer Daniel Martin Gallagher Jr sold a total of 12,500 shares at an average price of $22.80. The insider received around $284,990 from selling those shares.

- What's Happening: Robinhood Markets said it will release its second quarter 2024 financial results on Wednesday, Aug. 7.

- What Robinhood Does: Robinhood Markets Inc is creating a modern financial services platform.

- Benzinga Pro's earnings calendar was used to track HOOD’s upcoming earnings report.

Have a look at our premarket coverage here

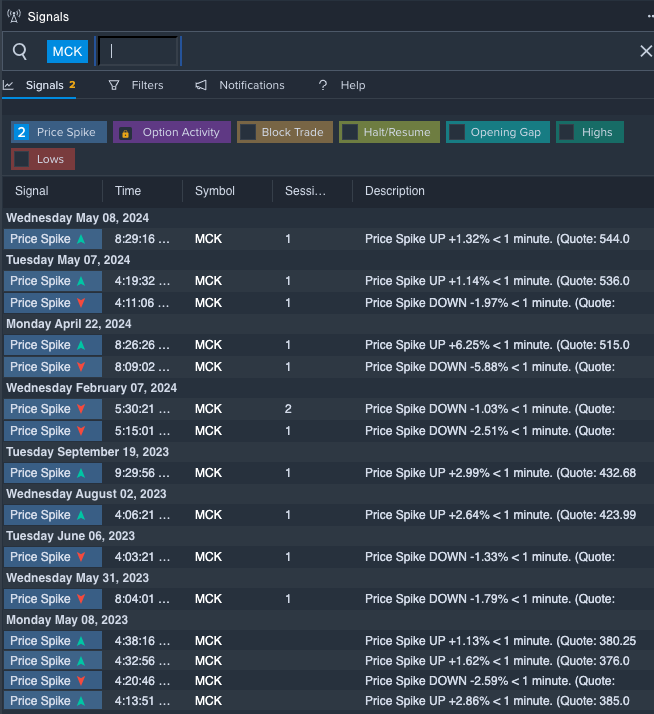

McKesson

- The Trade: McKesson Corporation MCK CEO Brian S. Tyler sold a total of 3,753 shares at an average price of $580.92. The insider received around $2.18 million from selling those shares.

- What's Happening: McKesson said it will release its first quarter fiscal 2025 financial results after the closing bell on Wednesday, Aug. 7.

- What McKesson Does: McKesson Corp is one of three leading pharmaceutical wholesalers in the us engaged in sourcing and distributing branded, generic, and specialty pharmaceutical products to pharmacies (retail chains, independent, and mail order), hospitals networks, and healthcare providers.

- Benzinga Pro's signals feature notified of a potential breakout in MCK’s shares.

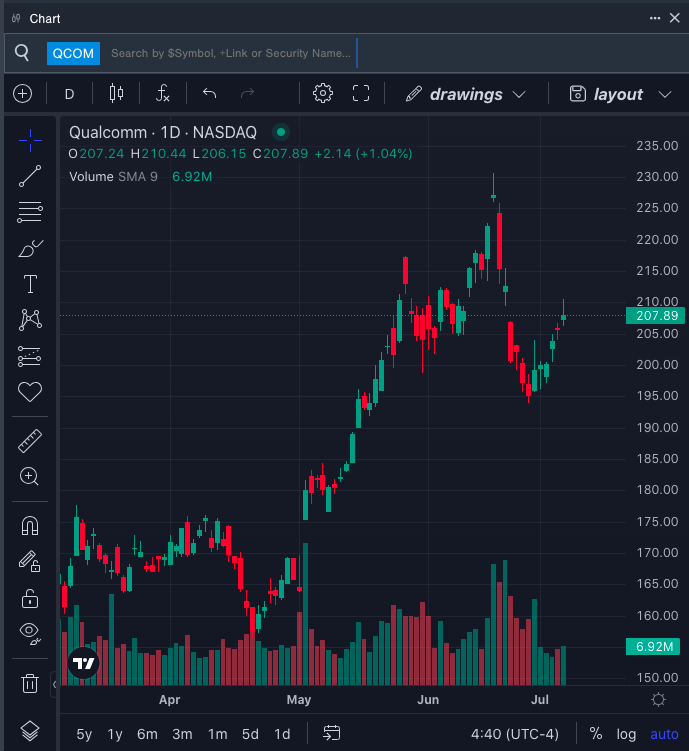

QUALCOMM

- The Trade: QUALCOMM Incorporated QCOM CFO and COO Akash J. Palkhiwala sold a total of 3,000 shares at an average price of $205.61. The insider received around $616,815 from selling those shares.

- What's Happening: On June 19, Qualcomm agreed to pay $75 million to settle a lawsuit with its shareholders, marking a victory for investors where Apple and global regulators previously failed.

- What QUALCOMM Does: Qualcomm develops and licenses wireless technology and designs chips for smartphones.

- Benzinga Pro's charting tool helped identify the trend in QCOM’s stock.

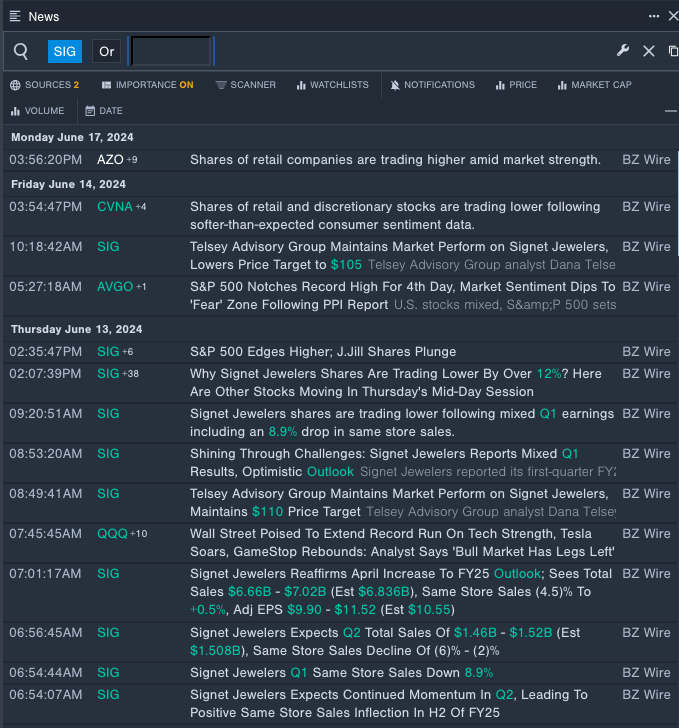

Signet Jewelers

- The Trade: Signet Jewelers Limited SIG Director Eugenia Ulasewicz sold a total of 3,334 shares at an average price of $87.94. The insider received around $293,207 from selling those shares.

- What's Happening: On June 13, the company reported a first-quarter FY25 sales decline of 9.5% year-on-year to $1.510 billion, missing the analyst consensus estimate of $1.514 billion.

- What Signet Jewelers Does: Signet Jewelers Ltd is a retailer of diamond jewelry. Its merchandise mix includes bridal, fashion, watches and others.

- Benzinga Pro's real-time newsfeed alerted to latest SIG’s news.

Check This Out: Wall Street’s Most Accurate Analysts Say Buy These 3 Utilities Stocks Delivering High-Dividend Yields

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.