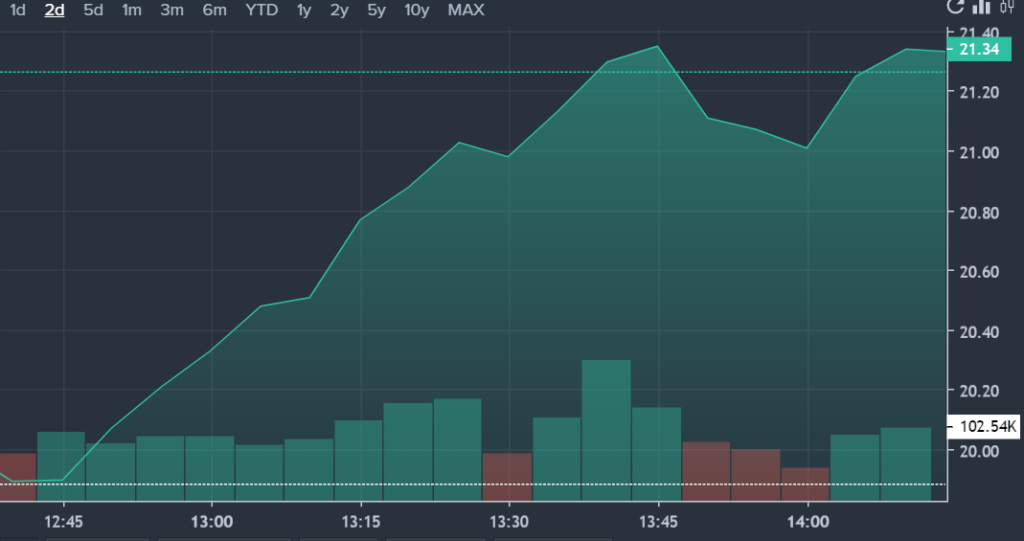

Aehr Test Systems AEHR shares are soaring Wednesday following robust fiscal Q4 2024 results and optimistic FY25 guidance.

What Happened: The semiconductor test equipment supplier reported fourth-quarter net revenue of $16.6 million, beating estimates of $15.44 million. Non-GAAP net income of $0.84 per share, beating the consensus estimate of $0.10.

For the fiscal year, Aehr achieved a record net revenue of $66.2 million.

Looking ahead, Aehr projects fiscal year 2025 revenue of at $70 million, surpassing the $65.1 million consensus estimate.

What Else: CEO Gayn Erickson also highlighted the role of silicon carbide power semiconductors in the company's success, driven by demand in the electric vehicle (EV) market. Aehr received $12.7 million in orders for its FOX WaferPak full wafer Contactors, reinforcing its strong position in the silicon carbide market. The company also announced the acquisition of Incal Technology, expanding its reach into the AI semiconductor market.

AEHR Price Action: Aehr Test systems shares were up by 23.7% at $20.84 according to Benzinga Pro.

See Also:

Photo Courtesy: buffaloboy on Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.