CF Industries Holdings, Inc. CF is poised to gain from higher nitrogen fertilizer demand in major markets and lower natural gas costs amid headwinds from softer nitrogen prices.

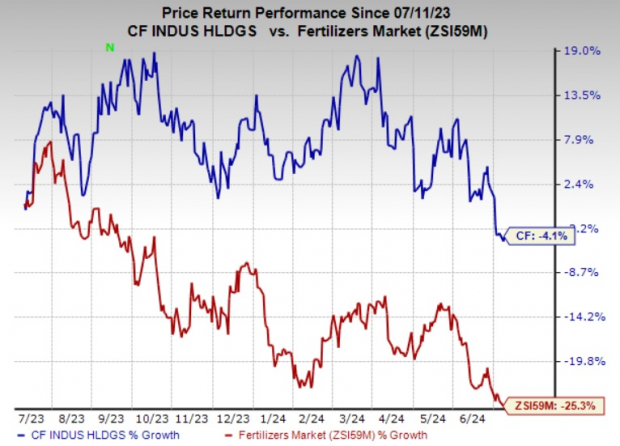

The company's shares have declined 4.1% over a year compared with a 25.3% decline of its industry.

Image Source: Zacks Investment Research

Let's find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

CF Gains on Healthy Nitrogen Demand, Lower Gas Costs

CF Industries is benefiting from rising global demand for nitrogen fertilizers, driven by significant agricultural demand. Industrial demand for nitrogen has also recovered from the pandemic-related disruptions. The company sees global demand to remain strong in the near future due to recovering industrial demand and farmer economics.

High levels of corn planted acres, low nitrogen channel inventories and favorable farm economics are expected to drive demand for nitrogen in North America. Demand for urea is also expected to remain strong in Brazil and India. Demand in India is expected to be driven by an uptick in domestic production on the back of higher operating rates and favorable weather conditions.

CF also stands to benefit from lower natural gas prices. It witnessed a significant decline in natural gas costs in the first quarter of 2024. The average cost of natural gas fell to $3.19 per MMBtu in the quarter from $6.62 per MMBtu in the year-ago quarter. Lower natural gas costs led to a decline in the company's cost of sales. The benefits of reduced gas costs are expected to continue in the second quarter of 2024.

Moreover, CF remains committed to boosting shareholders' value by leveraging strong cash flows. In the first quarter of 2024, the company repurchased 4.3 million shares for $347 million. The current $3 billion share repurchase program had around $2.2 billion remaining at the end of the first quarter. Earlier this year, the company also announced a 25% increase in quarterly dividend to 50 cents per share.

Weaker Nitrogen Prices Weigh on Margins

CF is exposed to headwinds from softer nitrogen prices. Global nitrogen prices have declined since the beginning of 2023. Higher global supply availability driven by higher global operating rates due to lower global energy costs has resulted in a decline in prices. Lower average selling prices weighed on CF's top line in the first quarter.

Selling prices fell in the quarter as decreased global energy costs reduced the global market clearance price required to meet global demand. The weak pricing environment is expected to continue over the near term. Lower pricing is likely to continue weighing on the company's sales and margins.

Stocks to Consider

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Axalta Coating Systems Ltd. AXTA and Cabot Corporation CBT.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company's shares have soared roughly 90% in the past year.

Axalta Coating Systems, carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 26.8% for the current year. In the past 60 days, the consensus estimate for AXTA's current-year earnings has been revised upward by 5.9%. The company's shares have gained roughly 3% in the past year.

Cabot currently carries a Zacks Rank #2. CBT has a projected earnings growth rate of 29% for the current fiscal year. The company's shares have rallied around 33% in the past year.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.