Darden Restaurants, Inc. DRI reported weaker-than-expected first-quarter financial results on Thursday.

The company reported adjusted earnings per share of $1.75, missing the analyst consensus estimate of $1.83. Quarterly sales of $2.76 billion missed the street view of $2.80 billion.

"While we fell short of our expectations for the first quarter, I firmly believe in the strength of our business," said Darden President & CEO Rick Cardenas.

Darden's directors have approved a quarterly cash dividend of $1.40 per share on the company's outstanding common stock. This dividend will be paid on November 1 to shareholders, as recorded as of the close of business on October 10.

Darden's shares gained 8.3% to close at $172.27 on Thursday.

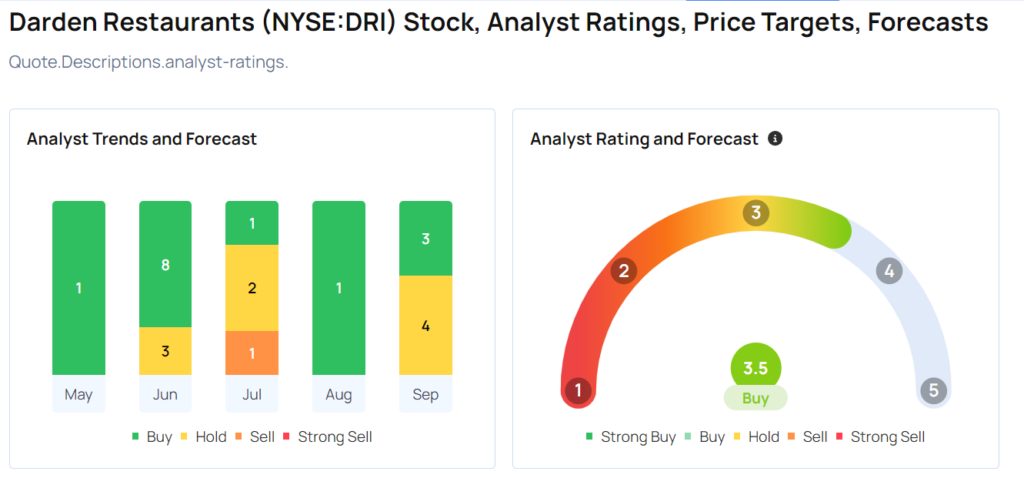

These analysts made changes to their price targets on Darden following earnings announcement.

- TD Cowen analyst Andrew Charles maintained Darden with a Hold and raised the price target from $150 to $165.

- Bernstein analyst Danilo Gargiulo downgraded the stock from Outperform to Market Perform and slashed the price target from $190 to $180.

- Stephens & Co. analyst Jim Salera maintained Darden with an Equal-Weight and raised the price target from $159 to $164.

- Wedbush analyst Nick Setyan maintained the stock with an Outperform and raised the price target from $170 to $200.

- Evercore ISI Group analyst David Palmer upgraded Darden Restaurants from In-Line to Outperform and raised the price target from $165 to $205.

Considering buying DRI stock? Here’s what analysts think:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.