Rio Tinto RIO announced that it would invest in Pongamia seed farms in Australia to explore the possibility of using its seed oil as a feedstock for renewable diesel. RIO sees biofuels as an avenue to reduce the dependence on fossil diesel, which accounts for around 10% of its emissions footprint in Australia.

To achieve net-zero Scope 1 and 2 carbon emissions by 2050, Rio Tinto has chosen electrification as the long-term solution for replacing the use of diesel in its fleet. While electrification is in progress, the company is looking at other quicker options to lower diesel-sourced emissions, such as biofuels.

Australia does not yet have a biofuel feedstock industry capable of meeting domestic demand. Rio Tinto expects that the pilot will play an important role in addressing this gap while supporting its journey to achieve decarbonization goals.

Rio Tinto Joins Forces With Midway for Pongamia Farm Trial

Pongamia is a fast-growing tree that is native to northern Australia. It produces large numbers of seeds, which are rich in oil and protein. The seeds can be processed into renewable diesel, which offers a significant reduction in carbon emissions compared with fossil fuel diesel.

After the extraction of oil, the seed pod and meal can be processed for other uses such as cattle feed. Pongamia has other benefits, it is drought tolerant, salinity and flood resistant, with low water, fertilization and pest control requirements making it easy to grow.

Rio Tinto is in the final stages of acquiring approximately 3,000 hectares of cleared land near Townsville in north Queensland to establish farms to study growth conditions and measure seed oil yields.

RIO has partnered with Midway Limited to oversee the planting and management of the seed farms. The companies will plant approximately 750,000 Pongamia saplings.

Rio Tinto's Decarbonization Efforts

In 2023, Rio Tinto's Scope 1 and 2 emissions were 32.6Mt CO2e, which marked a reduction of 5.5% from its 2018 baseline. It plans to invest capital in the range of $5- $6 billion by 2030 to deliver on its decarbonization strategy.

In July, RIO announced that it is set to install carbon-free aluminum smelting cells at its Arvida smelter in Québec, Canada, utilizing the first technology license issued by the ELYSIS joint venture. The groundbreaking ELYSIS technology aims to eliminate all direct greenhouse gases from the conventional aluminum smelting process by producing oxygen as a byproduct while improving efficiency by producing more aluminum at lower costs.

In May 2024, Rio Tinto and BHP Group BHP teamed up to trial large battery-powered haul trucks manufactured by Caterpillar CAT and Komatsu KMTUY in the Pilbara region of Western Australia. The trials will kick off with two Cat 793 haul trucks in 2024, followed by two Komatsu 930 haul trucks in 2026.

BHP will trial the Caterpillar trucks while Rio Tinto will test the Komatsu trucks. This collaboration between two leading global miners with two of the world's largest haul truck manufacturers seeks to address the critical challenge of achieving zero-emissions haulage in the mining sector.

Even though electrification is the most efficient and cost-effective solution to reduce the use of fossil diesel in mining fleet and equipment, Rio Tinto does not expect mass deployment of battery electric haul trucks at its operations to be technically or commercially feasible before 2030.

In the meantime, Rio Tinto intends to explore other avenues like biofuels to reduce diesel-sourced emissions. In June 2023, its Boron operation in California fully transitioned its heavy machinery from fossil diesel to renewable diesel. It is the first open pit mine in the world to achieve this feat. The company expects to replicate this at its Kennecott copper operation in Utah this year. It is also investigating the usage of biofuels in scenarios where electrification may be challenging to implement.

RIO's Price Performance & Zacks Rank

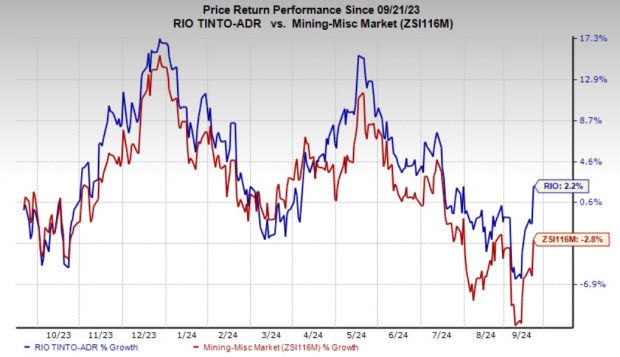

In a year, shares of Rio Tinto have gained 2.2% against the industry's 2.8% decline.

Image Source: Zacks Investment Research

Rio Tinto currently has a Zacks Rank #3 (Hold).

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.